Crypto Fundraises | May 14th - May 21st

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 13 funding rounds, collectively worth $139.5 million.

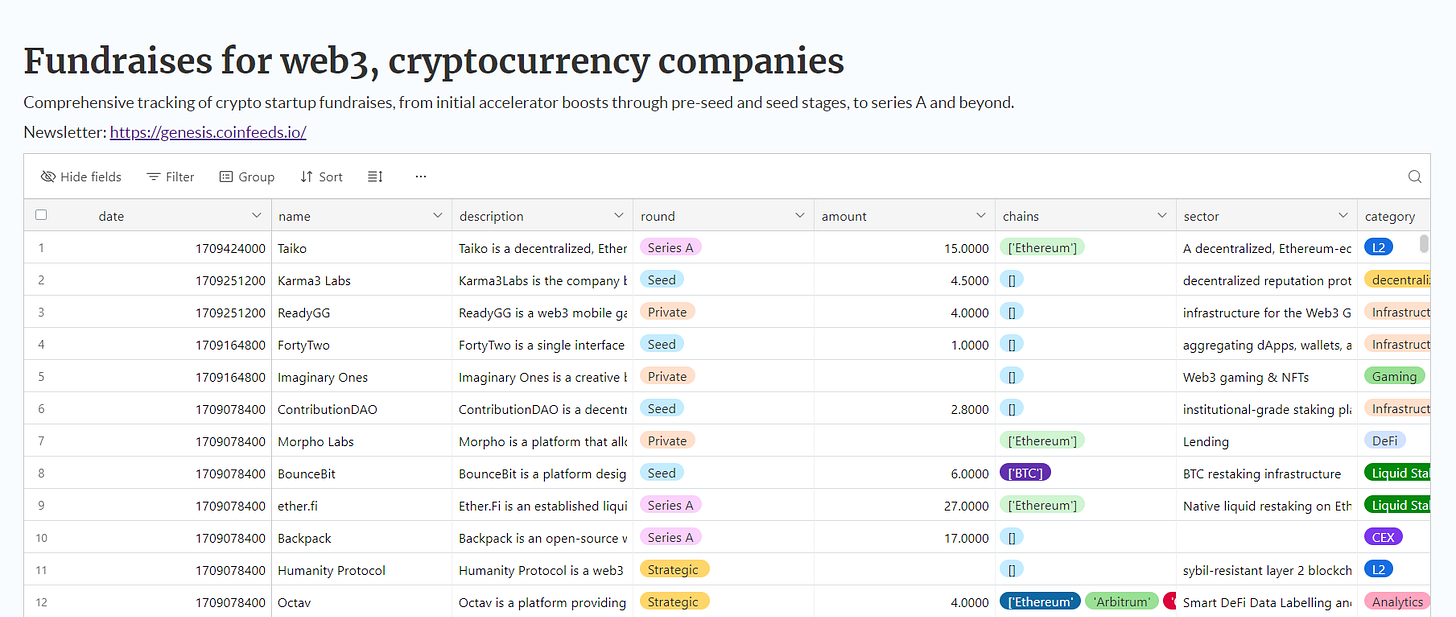

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

Below is a breakdown of the number of companies that fundraised by sector:

Infrastructure

Hylé is a blockchain platform focusing on enhancing privacy and trust through zero-knowledge proofs. It offers modular flexibility, allowing off-chain smart contract execution and diverse storage solutions while ensuring on-chain verifiability. Hylé raised on May 14th a Pre-Seed & Seed round of $3.4 million led by Framework Ventures, and followed by Cherry Ventures, First Capital, Fabric Ventures, and Heartcore Capital.

Chainstack is a versatile blockchain infrastructure provider that facilitates the development and management of blockchain applications across multiple networks. Offering tools like Elastic and Dedicated Nodes, Appchains, and various APIs, Chainstack supports enterprises in building scalable and secure applications. Chainstack raised a Strategic $6 million round on May 16th from SBI Ven Capital, Sygnum, Azimut Group, Unicorn Factory Ventures, and Ventech Ventures.

Peaq is a Layer-1 blockchain designed for Decentralized Physical Infrastructure Networks (DePIN), supporting scalable and environmentally-friendly solutions across multiple industries. It provides modular functions to power and tokenize real-world assets like vehicles and machinery, facilitating seamless integration with Web3 technologies. peaq raised on May 17th $20 million in a CoinList sale.

Blockless is a customizable, WASM-based execution layer designed for decentralized serverless applications. Operating as a permissionless network, it allows participants to contribute various hardware resources, from Android devices to high-performance servers. The company raised on May 20th a Pre-Seed & Seed round of $8 million led by NGC Ventures and followed by M31 Capital, Frachtis, No Limit Holdings, MH Ventures, Interop Ventures, and Plassa Capital.

Gaming

Cross The Ages is a collectible card game that combines fantasy and science fiction elements within a mobile-to-desktop gaming cycle, supported by blockchain technology. The platform allows players to collect cards, engage in solo adventures or compete in arenas against other players. Cross the Ages raised a $3.5 million Private round on May 15th led by Animoca Brands and followed by Polygon and Ubisoft Entertainment SA.

Param Gaming is a platform dedicated to enhancing the esports ecosystem. It offers a suite of tools and services designed to support and streamline operations for esports teams and organizations. This includes management systems, fan engagement solutions, and analytics. Param Labs raised a Private round of $7 million on May 16th led by Animoca Brands and followed by Delphi Digital, Mechanism Capital, Merit Circle, P2 Ventures, TRGC, MH Ventures, Yat Siu, Mehdi Farooq, and others.

DeFi

Shogun is a DeFi protocol designed to simplify the user experience in decentralized finance by eliminating concerns about blockchain specifics such as chains, gas, or wallets. It supports multiple execution environments including EVM and SolanaVM. On May 15th, Shogun raised a Seed round of $6.9 million round led by Polychain Capital and Dao5, and followed by Maelstrom Fund, Build-a-Bera, Cobie, Ansem, and others.

Polymarket is a prediction market platform where users can speculate on the outcomes of real-world events, from politics to pop culture. It leverages blockchain technology to ensure transparency and security in trading. Polymarket raised on May 14th a $45 million Series B round led by Founders Fund and followed by 1Confirmation, ParaFi, Vitalik Buterin, and Dragonfly Capital.

DEX

Zeta Markets is a decentralized exchange offering fast and secure trading on the Solana blockchain, emphasizing low fees and high-speed transactions. It supports up to 20x leverage trading, providing a platform that's both provably fair and transparent. On May 14th, Zeta Markets raised a $5 million SAFT round led by Electric Capital and followed by DACM, Airtree, Selini Capital, 0xMert,, Genia, y2kappa, Nom, and others.

Marginal is a decentralized finance platform that allows trading with leverage fully on-chain. It introduces unique features such as passive liquidity with insurance and automated hedging to protect liquidity providers, and no auto-deleveraging to ensure traders are always paid through physical settlement. On May 16th, Marginal raised a Pre-Seed round led by Nolimit Holdings and BaboonVC, and followed by NxGen, Cogitent Ventures, Tenzor Capital, Vessel Capital, Pivot Global, coinguru, WSBmod, and others.

Trading

Raven is a DeFi-first organization that provides liquidity across multiple blockchains and exchanges to facilitate fair and efficient crypto markets. They partner with new crypto projects to assist with token launches, offering insights on tokenomics, system architecture, and growth strategies. On May 15th, Raven raised a $2.7 million Seed round led by Hack VC and followed by Wintermute Ventures.

Web3

Focus Tree is a Web3 productivity app that encourages users to minimize phone usage through engaging community activities like airdrops and partnerships with other platforms. Focus Tree raised on May 17th a $2 million Seed round led by Sfermion and followed by Volt Capital, Psalion, Typhon Ventures, and Foresight Ventures.

L1

Humanity Protocol is a Web3 initiative aimed at preserving digital identity in an era dominated by data and artificial intelligence. It focuses on safeguarding individual privacy and authenticity, promoting decentralized solutions that allow users to manage and prove their identities without invasive checks. The project raised on May 15th a $30 million Seed round led by Kingsway Capital and followed by Animoca Brands, Blockchain .com, and Shima Capital.