Crypto Fundraises | March 5th - March 12th

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 21 funding round.

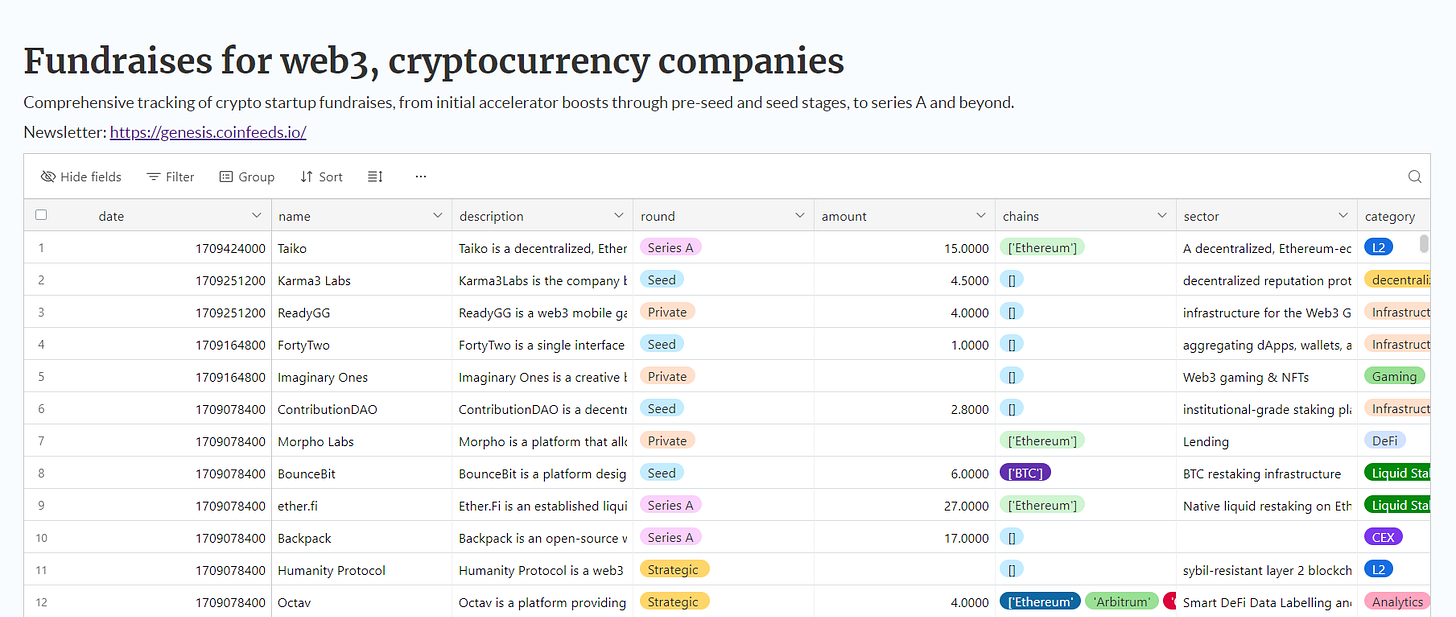

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

Below is a breakdown of the number of companies that fundraised by sector:

DeFi

Blackwing is a modular blockchain designed specifically for margin trading, allowing users to trade any asset natively without the risk of liquidation. It leverages the technology of Initia and is supported by notable figures in the industry, aiming to revolutionize how assets are traded by incorporating risk management directly into its blockchain infrastructure. Blackwing raised on March 7th a $7.5 million Seed round led by Hashed, gumi Crypto Capital, and followed by Alpha Lab Capital, Coin98 Ventures, CyberX, Saison Capital, K300 Ventures, DCF God, Fiskantes, 0xbrent, Rooter, and many others.

Derivio is a decentralized ecosystem designed to reimagine the trading of decentralized derivatives, offering the highest organic yield. It serves as a comprehensive suite for both speculative and hedging needs across digital assets, aiming for a seamless experience for traders, developers, and institutions. On March 8th, the project raised a Private round from Binance Labs.

UXUY is a one-stop decentralized exchange that facilitates trading across major cryptocurrencies, emphasizing ease of access with mobile apps for iOS and Android, alongside features like cross-chain transactions through uPool for seamless trading experiences. UXUY raised on March 8th a Private round from Binance Labs as part of its accelerator program.

Ethena is a platform dedicated to creating synthetic dollars and offering internet-native yield, with initial backing from prominent figures in the DeFi space. It aims to attract users by offering synthetic assets and yield generation opportunities, highlighted by a zero percent APY on sUSDe for early adopters. Ethena raised on March 8th a Private round from Binance Labs.

Infrastructure

Hedgehog Protocol is a modular synthetic blockspace designed to allow users to hedge, trade, and profit from gas fees across various blockchain ecosystems, including rollups, exchanges, and more. It introduces a concept called Synthetic Blockspace to mirror the economic essence of blockchain transactions without the complexities of physical blockspace. Hedgehog raised on March 6th a Pre-Seed round of $1.5 million from Marshland Capital, Tenzor Capital, Prometheus Ventures, 3Commas Capital, Nothing Research, Ivangbi, Vasiliy Shapovalov, and Banteg.

TON is a decentralized and open internet created with technology designed by Telegram. It focuses on providing a community-driven, secure, and reliable platform that integrates a decentralized network, facilitating various operations like transactions, games, and collectibles through its native cryptocurrency, Toncoin. The TON company raised on March 6th a Secondary Market round of $8 million.

Ionet is a decentralized cloud platform designed for large-scale AI applications, offering significant cost savings on compute resources by utilizing global GPU networks. It supports instant deployment of clusters with compatibility for leading ML frameworks like TensorFlow and PyTorch, emphasizing ease of use and efficiency for developers. The company raised a Series A round of $30 million on March 5th that was led by Hack VC, which put its valuation at $1 billion.

Security

Zama is an open-source company developing state-of-the-art solutions for Fully Homomorphic Encryption, aimed at enhancing privacy in blockchain and AI applications. Their technology allows data scientists to run models on encrypted data without needing to learn cryptography, enabling a wide range of privacy-preserving use cases. Zama raised a $73 million Series A round on March 7th that was led by Multicoin Capital and Protocol Labs, and followed by Metaplanet, Blockchange Ventures, Vsquared Ventures, Stake Capital, and several individuals.

Firewall is a platform dedicated to bolstering the security of EVM-based applications. It innovates by providing programmable finality and a proof-of-exploit consensus mechanism, aiming to eradicate smart contract vulnerabilities. Firewall raised a Pre-Seed round of $3.7 million on March 6th that was led by North Island Venture, Breyer Capital, and Hack VC, and followed by Finality Capital Partners, Kain Warwick, Smokey The Bera, Tim Ogilvie, and other individuals.

NFT

NFTfi is a peer-to-peer platform that enables NFT owners to use their digital assets as collateral for crypto loans. It connects borrowers and lenders directly, allowing for transparent, secure transactions without the need for intermediaries. Borrowers can list their NFTs and receive loan offers in cryptocurrencies like wETH, DAI, or USDC. On March 11th, NFTfi raised a Series A1 round of $6 million led by Placeholder and followed by Maven 11, Kahuna, Launch Labs, Brevan Howard, The Lao, Reciprocal Ventures, A.Capital, HASH CIB, Bloccelerate, Cypher Capital, and Longhash Ventures.

Governance

Shogun Protocol is a pivotal platform within the Polygon ecosystem, aiming to revolutionize yields and governance, starting with Meshswap. It enhances earning potential by offering users the opportunity to earn additional MESH and SHO tokens, plus trading fees, while remaining fully liquid with shoMESH, a top-tier asset on Meshswap. The company raised a Private round on March 8th from Binance Labs as part of its accelerator program.

QnA3 is a platform that leverages extensive Q&A data to identify the underlying intentions behind users' queries. Recognizing that expressed desires, such as buying a popular token, often serve as pathways to deeper goals like making money through trading, QnA3 aims to uncover and address these foundational aims. The company raised on March 8th a Private round that was led by Binance Labs.

Gaming

Cellula is a fully on-chain artificial life simulation game where life begins with cells. Players engage with cells containing 1-9 active genes, exploring 511 unique cell types. The game emphasizes the creation and evolution of life from cells, encouraging players to experiment and build autonomous worlds through a bottom-up approach. On March 8th, Cellula raised a Private round led by Binance Labs.

Blockus is a comprehensive platform for Web3 gaming, providing tools for game studios to effortlessly build, deploy, and manage games on blockchain technology. It offers unified Web2 and Web3 logins, in-game commerce, complete NFT management, and integration with major gaming chains. Blockus raised on March 11th a $4 million Pre-Seed round led by Maple VC and followed by Altos Ventures, Zhuoxun Yin, Michael Ma, and Bryan Pellegrino.

AI/ML

Sahara AI is a decentralized ecosystem focused on empowering individuals to own, scale, and monetize their knowledge using blockchain technology. This innovative platform allows users to create autonomous AI agents tailored to their expertise, thereby amplifying their knowledge's impact and exploring new income avenues. On March 5th, Sahara raised a $6 million Seed round led by Polychain Labs and followed by Samsung Next, Matrix Partners, Motherson Group, Canonical Crypto, Dao5, Alumni Ventures, and many others.

L2

Eclipse is a high-speed Layer 2 solution on Ethereum, utilizing the Solana Virtual Machine (SVM) to offer superior performance, security, and scalability for decentralized applications. It focuses on optimized parallel execution, enabling massive scale operations while maintaining Ethereum's security properties through a validating bridge. Eclipse raised on March 11th a $50 million Series A round led by Placeholder and Hack VC, and followed by Polychain Capital, Maven 11, DBA, Delphi Digital, Fenbushi Capital, Bankless Ventures, Flow Traders, OKX Ventures, and many others.

Developer Tools

Baanx is a modular FinTech platform that leverages blockchain to merge fiat and digital assets, offering APIs for customizable digital products. It facilitates instant card services, digital asset management, payments, and comprehensive compliance solutions. Baanx aims to quickly transform Fintech visions into reality, supporting fast, low-cost international transactions and compliance as a service. Baanx raised a Series A round of $20 million on March 5th that was led by Ledger, Tezos Foundation, Chiron, and British Business Bank, and followed by Multicoin Capital, 6th Man Ventures, M13, Delphi Digital, Solana Labs, Aptos Labs, Foresight Ventures, Longhash Ventures, Animoca Brands, MH Ventures, Sandbox, and many others.

Cosmology is a toolkit designed to empower developers within the Cosmos ecosystem, focusing on enhancing the creation and management of Web3 applications. It aims to streamline development processes and foster innovation through user-friendly tools and resources, catering specifically to the needs of the IBC protocol. Cosmology raised on March 7th a $5 million Seed round led by Galileo and Lemniscap, and followed by Dispersion Capital, HashKey Capital, Tuesday Capital, Osmosis Foundation, Chorus One, and Informal Systems.

Utila is a leading MPC wallet platform for institutions, simplifying crypto operations across multiple chains, wallets, and users. It offers secure trading and treasury management, developer tools, and advanced security features like MPC technology and customizable policy engines. The project raised an $11.5 million Seed round on March 5th that was led by NFX, Wing Venture Capital, and Framework Ventures, and followed by Fasanara Digital Ventures, North Island Ventures, Republic Capital, Liquid 2 Ventures, Inspired Capital Partners, Lyrik Ventures, Big Brain Holdings, and others.

Marketing

NFPrompt.io is an AI-powered platform designed as an entry point to Web3, offering tools and resources to explore, create, earn, and run campaigns in the blockchain space. It aims to simplify the transition and integration into Web3 technologies for users and creators. The project raised on March 8th a Private round from Binance Labs as part of its program.

Wallets

Oyl is an upcoming Bitcoin wallet and trading platform aiming to simplify the trading of Ordinals and BRC-20s, advocating for seamless transactions on a platform where Bitcoin's robustness enhances trading experiences. They emphasize the efficiency and security of trading on Bitcoin, suggesting that assets from other chains can be optimized within this ecosystem. The company raised on March 7th a Pre-Seed round of $3 million that was led by Arca and followed by Domo and Maelstrom Fund.