Crypto Fundraises | March 26th - April 2nd

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 20 funding rounds.

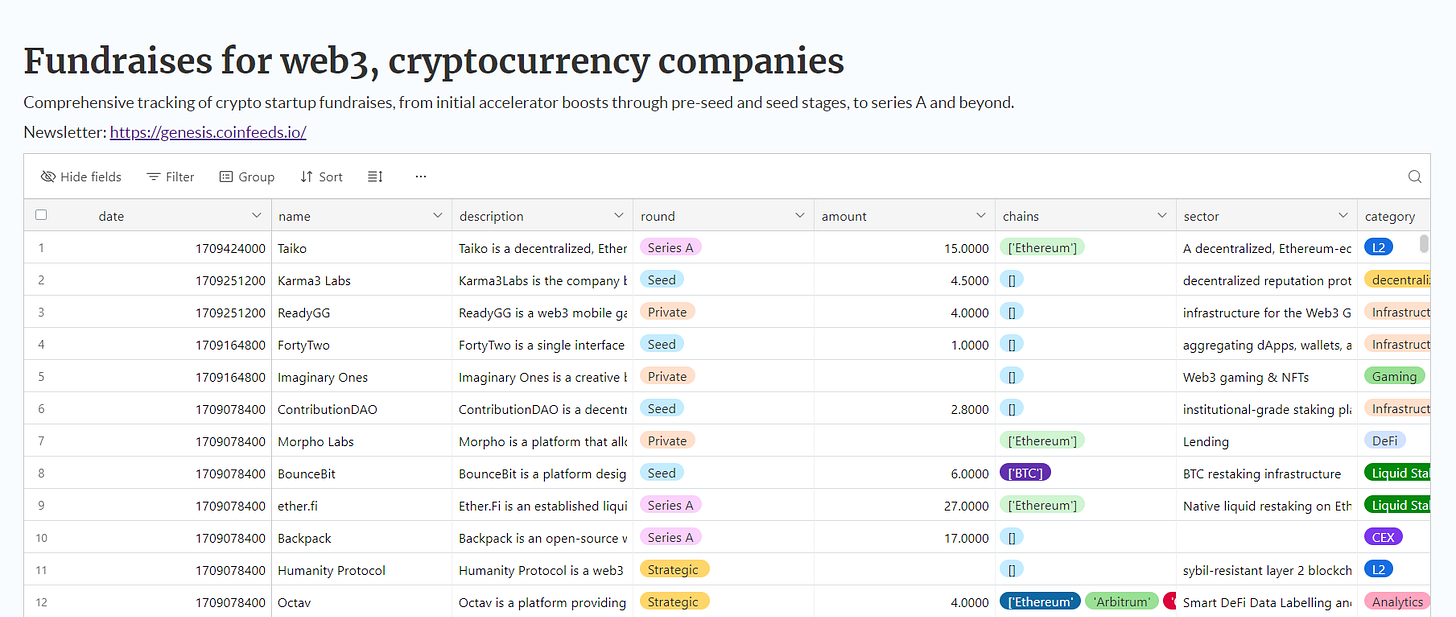

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

Below is a breakdown of the number of companies that fundraised by sector:

Gaming

Illuvium is a decentralized studio creating the first interoperable blockchain game universe on Ethereum. It combines an open-world exploration game, a city builder, and an autobattler, offering a rich, graphically intensive sci-fi adventure. Players can explore alien landscapes, capture creatures called Illuvials, and engage in strategic battles, with complete ownership of in-game assets thanks to blockchain technology. On March 27th, Illuvium raised a $12 million Series A round of $12 million from Arrington Capital, King River Capital, Animoca Brands, The Spartan Group, GoldenChain, Arca, Selini Capital, Laser Digital, and others.

Gunzilla Games is a pioneering game development studio focusing on creating next-generation multiplayer shooters, integrating blockchain to revolutionize player engagement and ownership of in-game assets. Their mission involves pushing the boundaries of interactive entertainment by offering unique gaming experiences that blend cutting-edge technology with engaging gameplay narratives. Gunzilla raised on March 26th a Strategic $30 million round led by CoinFund and Avalanche Foundation, and followed by Morningstar Ventures and Republic Capital.

MyPrize is a platform designed to make winning a collective experience, where users can join to start earning XP and prizes. It emphasizes community engagement and rewards, supported by notable backers in the tech and investment world. Myprize raised an Equity+Token round of $13 million led by Dragonfly and Boxcars Ventures, and followed by Mechanism Capital, a16z Scout, Arrington Capital, Breed VC, JST Capital, 2 Punk Capital, Luka Netz, Peter Smith, and other individuals.

Elixir Games is a builder of a PC Game Launcher that revolutionizes gaming with a curated selection of indie games. It facilitates easy game installation and play on Windows, Mac OS, and Linux. Players can collect and trade in-game assets and skins, enhancing the gaming experience with web3 components for deeper engagement. On March 27th, Elixir raised a $14 million Seed round from Square Enix, Shima Capital, and Solana Foundation.

BloodLoop is an MMO-NFT game that draws inspiration from top competitive video games, offering players a platform to showcase their skills and own their assets in a hero-shooter setting. It's designed to combine engaging gameplay with the blockchain's asset ownership capabilities. BloodLoop raised on March 28th a $4 million Seed round led by Avalanche Foundation, Merit Circle, and Citizen Capital, and followed by Neo Tokyo, GD10, Optic Capital, Dutch Crypto Investors, GameFi Ventures, Founder Heads, and Oracle Investment Group.

AI

MyShell is an AI consumer layer to bridge the gap between users, creators, and AI researchers. It offers a platform for engaging with AI friends and work companions, enabling voice and video interactions with real actions and expressions. By leveraging cutting-edge generative AI models, MyShell allows anyone to quickly transform ideas into AI-native apps, fostering a new creator economy where individuals can own and monetize their innovations. MyShell raised on March 27th a pre-Series A round of $11 million led by Dragonfly and followed by Delphi Ventures, Bankless Ventures, Maven 11 Capital, Nascent, Nomad Capital, and OKX Ventures.

FLock is a platform designed to streamline and enhance business operations through effective team communication and project management tools. It aims to facilitate seamless collaboration within teams, improving workflow and productivity. FLock raised on March 28th a $6 million Seed round led by Lightspeed Faction and Tagus Capital, and followed by DCG, OKX Ventures, and Volt Capital.

0G is a modular AI chain designed to revolutionize Web3 development by offering scalable, secure, and programmable data availability layers for AI DApps. It aims to enhance Web3 and GenAI integration with features like decentralized inference, on-chain AI app development, and interoperability across decentralized networks. 0G raised on March 26th a $35 million Pre-Seed round from Hack VC, Morningstar Ventures, Allance DAO, Animoca Brands, Delphi Digital, Stanford Builders Fund, and others.

DeFi

The ALEX Lab Foundation is a non-profit organization dedicated to the governance and expansion of the ALEX DeFi protocol, aiming to advance decentralized financial infrastructure on the Web3. It supports governance, research, education, and the launch of new tokens through IDOs, providing a fair and decentralized platform for emerging projects. The company raised on March 26th a Strategic $10 million round led by Spartan Capital and followed by CMS Holdings, DACM, DWF Labs, Foresight Ventures, G-20 Group, Ouroboros Capital, Summer Capital, Cultur3 Capital, and EVG.

Unstable is a leverage layer for restaked ETH, offering innovative financial instruments to maximize returns on Ethereum staking. It enables users to leverage their staked ETH assets, enhancing yield potential and liquidity. Unstable raised on March 27th a $2.5 million Seed round from Lattice, Laser Digital, Blockchain Founders Fund, Assouline Ventures, Agnostic Fund, Artichoke Capital, NxGen, New Tribe Capital, and Black Edge Capital.

Midas is a platform for earning interest on US Treasuries through a permissionless ERC-20 token, combining traditional financial stability with DeFi applications. With a variable APY, it provides a secure, regulatory-compliant way to invest in US T-Bills, supported by high-quality banking, financial partners, and institutional-grade security. Midas raised a $8.75 million round on March 30th from BlockTower Capital, Framework Ventures, and HV Capital, and followed by Coinbase Ventures, Ledger, GSR Ventures, HackVC, 6th Man Ventures, Axelar, FJ Labs, and PeerCapital.

L1

XION is the first Layer 1 blockchain crafted specifically for consumer adoption, aiming to empower developers and brands to create seamless Web3 experiences. It introduces a Generalized Abstraction layer to simplify blockchain interaction for users, facilitating the development, launch, and scaling of consumer-ready products with features like Meta Accounts, signature and gas abstraction, and a seamless mobile experience. On April 1st, XION raised a $25 million Series A round from Animoca Brands, Laser Digital, Multicoin Capital, Draper Dragon, Arrington Capital, Sfermion, GoldenTree, Mechanism Capital, Morningstar Ventures, and many others.

Peaq is a blockchain network aimed at powering real-world applications, particularly focusing on decentralized personal Internet nodes (DePINs) and decentralized applications (dApps) for sectors like mobility, connectivity, and energy. It's designed for high scalability and environmental friendliness, supporting over 100,000 transactions per second with a minimal ecological footprint. Peaq raised a $15 million Series A round on March 27th led by Generative Ventures and Borderless Capital, and followed by The Spartan Group, Moonrock Capital, HV Capital, CMCC Global, Animoca Brands, Fundamental Labs, TRGC, DWF Labs, Crit Ventures, and others.

DEX

Arrow Markets is an options trading platform that incorporates an innovative RFQ (Request for Quote) system, designed to streamline and simplify the trading process. It features a user-friendly interface that caters to traders of all skill levels, offering highly competitive option quotes and a recommendation engine to guide users. On April 1st, Arrow raised a Series A round of $4 million led by Framework Ventures and Blizzard Fund, and followed by Bixin Ventures, CoinList, Crypto.com, Finality Capital Partners, GSR Ventures, G-20 Group, Gate Labs, Ledger Prime, Trader Joe, and Delphi Digital.

Merkle Trade is the first gamified perpetual decentralized exchange (DEX), blending trading with gaming elements to level up and unlock rewards. It offers a zero gas fee structure, 1-click trading, and supports crypto, forex, and commodities with up to 1000x leverage. The platform promises an exceptional trading experience with fast order execution and omnichain onboarding. The company raised on April 1st a $2.1 million Seed round led by Hashed, and Arrington Capital and followed by Morningstar Ventures, Aptos Labs, Amber Group, Re7 Capital, Dorahack, and Hashed.

L2

BOB (Build on Bitcoin) is the first Layer 2 solution that synergizes the security and liquidity of Bitcoin with Ethereum's flexibility, offering Full EVM compatibility and native Bitcoin support. It's designed to facilitate DeFi and broader Bitcoin-based innovations, leveraging Ethereum Virtual Machine for smart contract execution and developer tool compatibility. The project raised on March 27th a $10 million Seed round led by Castle Island Ventures and followed by Mechanism Capital, Bankless Ventures, CMS Ventures, and UTXO Management.

Infrastructure

Biconomy is a provider of plug-and-play APIs designed to streamline the web3 experience, making blockchain interactions seamless for users and developers. It focuses on simplifying onboarding, transactions, and dApp development with tools like modular smart accounts, gasless transactions, and account abstraction. Biconomy raised on March 28th an undisclosed Strategic round.

Web3

dappOS is a foundational layer for Web3, aiming to simplify the development and user experience of decentralized applications (DApps) through an integrated operating system. This approach seeks to bridge the current gap between blockchain technology's potential and its practical application, making DApp interaction more intuitive and accessible. On March 31st, dappOS raised a Series A round of $15.3 million led by Polychain and followed by Nomad Capital, IDG Capital Vietnam, NGC Ventures, Amber Group, and others.

Storage

HiveNet is a platform providing distributed cloud storage and computing, emphasizing eco-friendliness by utilizing unused storage spaces on personal devices. It offers secure and private cloud solutions, aiming to lower costs and reduce the carbon footprint of digital storage and processing. Hive raised on March 27th a Series A round of $13 million led by SC Ventures and followed by OneRagtime.