Crypto Fundraises | March 12th - March 19th

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 12 funding rounds.

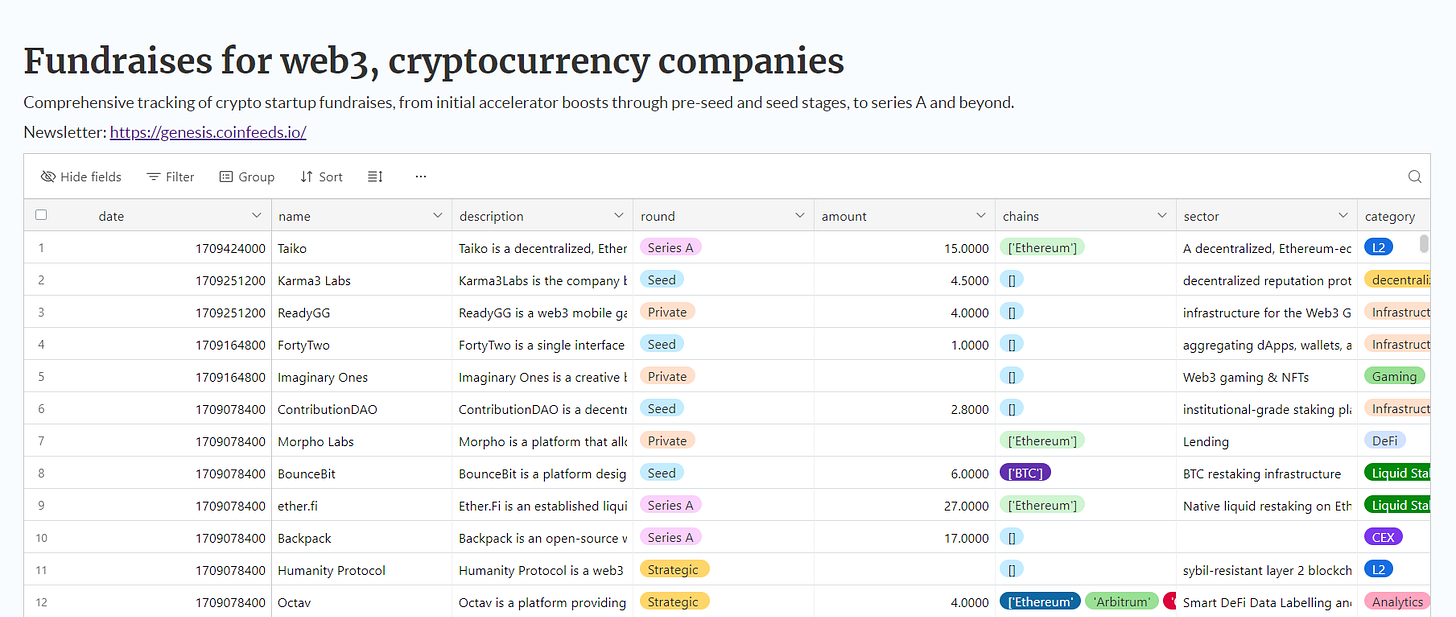

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

Below is a breakdown of the number of companies that fundraised by sector:

DeFi

Figure Markets is a decentralized marketplace designed for trading crypto assets, offering individuals and institutions a platform to trade, borrow, and invest. It emphasizes seamless integration for trading Bitcoin, Ordinals, and BRC-20s directly within users' wallets, aiming to make the process as intuitive as using any blockchain, but with the added advantage of Bitcoin's robust financial backing. Figure raised on March 19th a Series A round of $60 million led by Jump Crypto, Pantera Capital, and Lightspeed Faction, and followed by Distributed Global, Ribbit Capital, CMT Digital.

Fjord Foundry is a platform specializing in Liquidity Bootstrapping Pools (LBPs), aiming to democratize access to new, innovative projects by connecting them with engaged backers in a fair and transparent way. It has facilitated over $840 million in funds raised, supporting more than 500 bootstrapped communities. The company raised on March 13th a $4.3 million Seed round led by Lemniscap and followed by Mechanism Capital, Zee Prime Digital, DCD, UniswapVillain, Rager, JZ, Kieran Warwick, and Fomosaurus.

Elixir is a decentralized finance platform that facilitates yield farming and liquidity provision on the Ethereum blockchain. It leverages automated smart contracts to offer users optimized strategies for earning yield on their cryptocurrency investments. Elixir focuses on security, efficiency, and maximizing returns for its users, providing a user-friendly interface for engaging with DeFi products. Elixir raised a Series B round of $8 million that was led by Mysten Labs and Maelstrom, and followed by GSR Ventures, Manifold, Arthur Hayes, Amber Group, and Flowdesk.

D2X is a secure, EU-regulated market infrastructure builder for institutional trading of crypto futures and options. It provides a capital-efficient and robust platform, emphasizing regulatory compliance, risk management, and high-performance tech for trading digital assets like BTC and ETH against the EUR. The company raised a $10 million Series A round led by Point 72 Ventures and followed by GSR Markets, Tioga Capital, Fortino Capital, Jabre Capital Partners, Picus Capital, and TRGC.

Infrastructure

Berachain is a high-performance, EVM-compatible blockchain based on Proof-of-Liquidity consensus, designed to defragment liquidity and turbocharge applications. It offers simple DeFi legos and pools, built into the chain and powered by validators, aiming to solve stake centralization and build security via liquidity. Berachain raised on March 15th a Private round of $69 million that was led by Brevan Howard Digital and Framework Ventures.

Polyhedra Network is a cross-chain interoperability protocol designed to facilitate seamless asset transfer and communication between different blockchains. It aims to enhance the connectivity and functionality of decentralized applications by enabling them to operate across multiple blockchain ecosystems efficiently. On March 13th, Polyhedra raised a Strategic $20 million round that was led by Polychain and followed by Animoca Brands, Emirates Consortium, MapleBlock Capital, Hashkey Capital, UOB Ventures, Longhash Ventures, and others. This put its valuation at $1 billion.

Clique is a heterogeneous computing resources company that innovates through its Compute Coordination Network. It supports customizable, market-efficient computation for applications and smart contracts, incorporating co-processors, oracles, and specialized hardware to meet diverse needs around trust, privacy, and performance. The project raised on March 14th a $14 million Series A round that was led by Polychain Capital and followed by Bankless, Robot Ventures, Cyber Fund, zkValidator, Offchain Labs, Smokey The Bera, Balaji Srinivasan, Sandeep Nailwal, and many others.

Security

TEN is the first Layer 2 solution bringing full data encryption to Ethereum, ensuring privacy without altering the core user or developer experience. It seamlessly integrates with the existing Ethereum ecosystem, allowing for encrypted dApps and smart contracts using standard Ethereum tools. TEN raised a $9 million round on March 15th that was led by R3 and followed by Republic Crypto, KuCoin Labs, Big Brain Holdings, Magnus Capital, and DFW Labs.

NFT

Pallet Exchange is a new type of NFT marketplace focused on user retention by creating a social and engaging trading environment. It operates on the Sei blockchain, chosen for its speed and low transaction costs, aiming to attract a broader audience through gamification and community features. Pallet raised on March 14th a $2.5 million Private round from The Spartan Group, Symbolic Capital Partners, and Cypher Capital.

Gaming

Param Labs is an independent game and technology development studio focusing on creating multiplayer blockchain games and leveraging innovative technologies. Specializing in AAA design, they aim to bridge the gap between Web2 and Web3, enhancing digital ownership and user-generated value in gaming. The company raised on March 14th a Private round that was led by Animoca Brands.

MetalCore is an immersive multiplayer combat game set on the planet Kerberos, blending mechanized warfare with blockchain-based asset ownership. Players can align with factions like the Gear Breakers, Metal Punks, or the Holy Corporation, or navigate as lone mercenaries. MetalCore raised on March 12th a $5 million Private round from Delphi Digital, Sanctor Capital, BITKRAFT Ventures, and The Spartan Group.

Munchables.app is a soon-to-launch vibrant, interactive gaming platform where users can reunite scattered clans across ethereal realms through engaging missions. Players will collect and evolve adorable on-chain companions, earning rewards and enhancing their Munchables through strategic gameplay. Munchables raised on March 13th a Pre-Seed round led by Manifold and Mechanism Capital, and followed by Selini Capital, Duplicate Capital, Hidden Street Capital, CBB0FE, DCF God, Shoku, NBS, and others.