Crypto Fundraises | June 4th - June 11th

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 15 funding rounds, collectively worth $199.55 million.

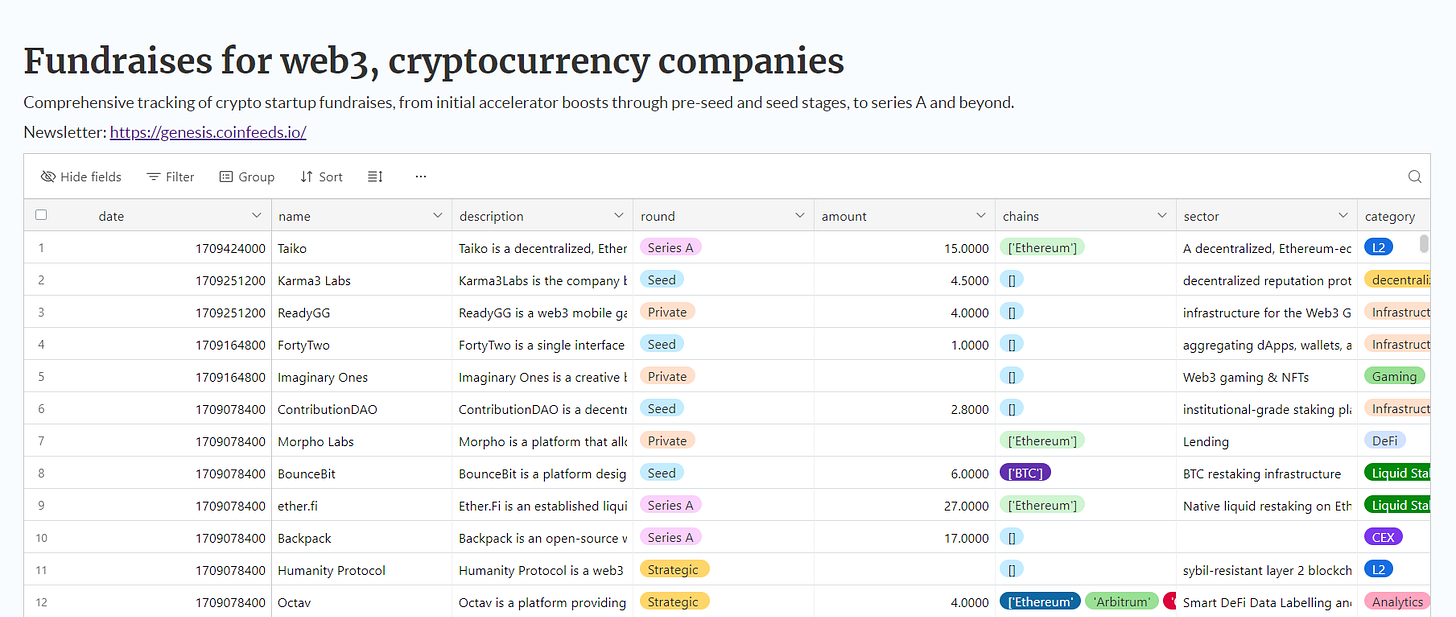

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

Below is a breakdown of the number of companies that fundraised by sector:

Infrastructure

Squads Protocol is a collection of programs on the Solana blockchain designed for building secure, smart contract-based wallet infrastructures. It enables account abstraction and is crafted to help scale the adoption of crypto, making it ideal for developing applications that introduce new users to the crypto ecosystem. On June 10th, Squads raised a Series A round of $10 million led by Electric Capital and followed by RockawayX, Coinbase Ventures, L1D, Placeholder, and Mert Mumtaz.

Glacier Network is the first data-centric blockchain, designed to address specific industry needs by enhancing data management and security on the blockchain. It focuses on optimizing the storage and retrieval of large data sets, making it particularly suitable for enterprises that handle extensive data operations. Glacier Network raised an Angel & Seed round of $8 million on June 6th from UOB Venture Management, Laser Digital, Foresight X, KuCoin Ventures, Signum Capital, Cogitent Ventures, Gate Labs, and many others.

Nubit is a Bitcoin-native data availability layer designed to enhance Bitcoin's capabilities. It supports applications like Ordinals and layer 2 solutions, improving scalability without compromising on security. On June 5th, Nubit raised an $8 million Seed led by Polychain Capital and followed by Nomad Capital, The Spartan Group, Big Brain Holdings, GCR, Protagonist, Mask Network, Animoca Brands, OKX Ventures, and others.

Avail is a Web3 infrastructure layer designed to enhance the scalability and interoperability of blockchain networks. It offers a modular execution platform called Avail DA, focusing on unifying blockchain applications like rollups and ensuring decentralized, trust-minimized interactions. Avail raised on June 4th a $43 million Series A round led by Dragonfly Capital, Founders Fund, and Cyber Fund, and folloed by SevenX Ventures, Figmnent Capital, LocalGlobe, Chapter One, Superscrypt, Foresight Ventures, and others.

Everclear is a decentralized platform designed to coordinate global liquidity settlement between blockchains, addressing fragmentation in modular blockchain environments. It enhances transaction efficiency by integrating with intent protocols, solver networks, and decentralized applications, enabling permissionless chain expansion and programmable settlement. Everclear raised an OTC round of $5 million on June 5th that was led by Pantera Capital.

Stablecoin

Mountain Protocol offers USDM, a yield-bearing stablecoin backed by short-term U.S. Treasuries, aiming for high security and transparency. It provides a permissionless, regulated, and bankruptcy-remote financial environment, suitable for both individual and institutional users. Mountain Protocol raised on June 6th a Series A round of $8 million led by Multicoin Capital and followed by Castle Island Ventures, Coinbase Ventures, Bankless Ventures, and others.

M^0 is an innovative on-chain protocol designed to transform the money issuance infrastructure by allowing multiple institutions to issue a fungible cryptodollar, M. It leverages high-quality, exogenous collateral such as short-term US Treasuries, ensuring solvency and security. M^0 raised a $35 million Series A round on June 5th led by Bain Capital Crypto and followed by Wintermute, Galaxy, GSR, Caladan, and SCB 10X.

Gaming

Xociety is a decentralized platform designed to enhance user experience in the Metaverse by integrating social networking, entertainment, and e-commerce features. It aims to provide a comprehensive virtual environment where users can interact, shop, and engage in various activities. Xociety raised on June 6th a pre-Series A round of $7.5 million from Hashed, Sui Foundation, The Spartan Group, Neoclassic, Big Brain Holdings, Krafton, Arena-Z, Mozaik Capital, and others.

The Sandbox is a virtual metaverse where players can create, own, and monetize their gaming experiences using NFTs and blockchain technology. It provides tools for users to build and customize their own virtual worlds and games, enabling a user-generated content ecosystem. The Sandbox raised a $20 million Strategic round on June 6th led by Kingsway Capital and Animoca Brands, and followed by LG Tech Ventures and True Global Ventures.

DeFi

Ink Finance is a platform that facilitates on-chain asset management and governance, designed specifically for DAOs, protocols, and asset managers. It offers a no-code interface for customizing asset management and governance frameworks, enhancing on-chain financial competence and credit. The company raised on June 7th a Seed and Strategic round of $5 million from Alliance DAO, DHVC, Revere, Avalanche, Polygon, Draper Dragon, Krypital Group, GSR, and more.

Payments

XREX is a fully regulated, blockchain-enabled financial institution that is collaborating with Tether to facilitate compliant, USDT-based cross-border B2B payments in emerging markets. This partnership is focused on driving innovation in the digital asset industry and improving regulatory technology to ensure safe and efficient financial transactions. XREX Group raised $18.75 million on June 5th in a Strategic round led by Tether.

NFT

Stashh is a marketplace for NFTs that emphasizes privacy for digital content such as videos, 3D models, music, and images. It enables creators to sell and users to purchase NFTs in a secure environment that protects the privacy of the content. Stashh raised a $3.3 million Private round on June 4th from Animoca Brands, 6th Man Ventures, Shima Capital, HashKey Capital, and Sfermion.

Social Platform

Halo is a Web3 social application designed to monetize social data through AI and a decentralized identity (DID) framework. It integrates a wallet aggregator to manage diverse assets and facilitates earning through social engagement. Halo promotes a unique monetization model within SocialFi, aiming to establish a new paradigm of UBI. On June 7th, Halo raised a $3 million Seed from IDG Capital, KuCoin Ventures, and HashKey Capital.

L2

Fhenix is an innovative layer 2 solution on Ethereum, designed to enhance on-chain confidentiality through fully homomorphic encryption (FHE). It allows for encrypted computation, supporting various use cases such as confidential voting, private auctions, and secure decentralized finance applications. Fhenix raised on June 4th a $15 million Series A round from Hack VC, Collider, Gate Ventures, Amber, Foresight Ventures, WAGMI Ventures, Primitive Ventures, Dao5, and others.

Cybersecurity

GOPLUS is a security-focused platform that provides comprehensive security services and infrastructure for blockchain ecosystems. It specializes in identifying and mitigating risks related to smart contracts and blockchain applications through advanced security audits, threat intelligence, and real-time monitoring tools. On June 5th, GoPlus raised a $10 million Strategic round from OKX Ventures, HashKey, and Animoca Brands.