Crypto Fundraises | June 25th - July 2nd

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 15 funding rounds, collectively worth $172.4 million.

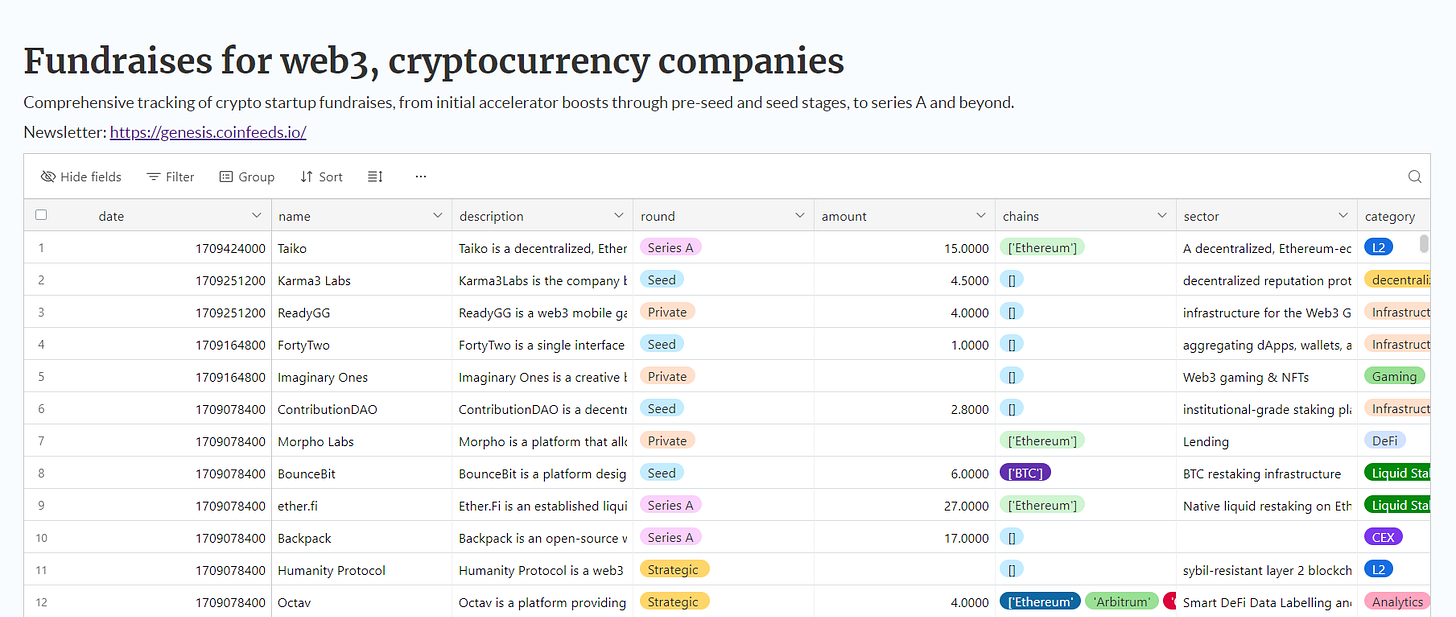

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

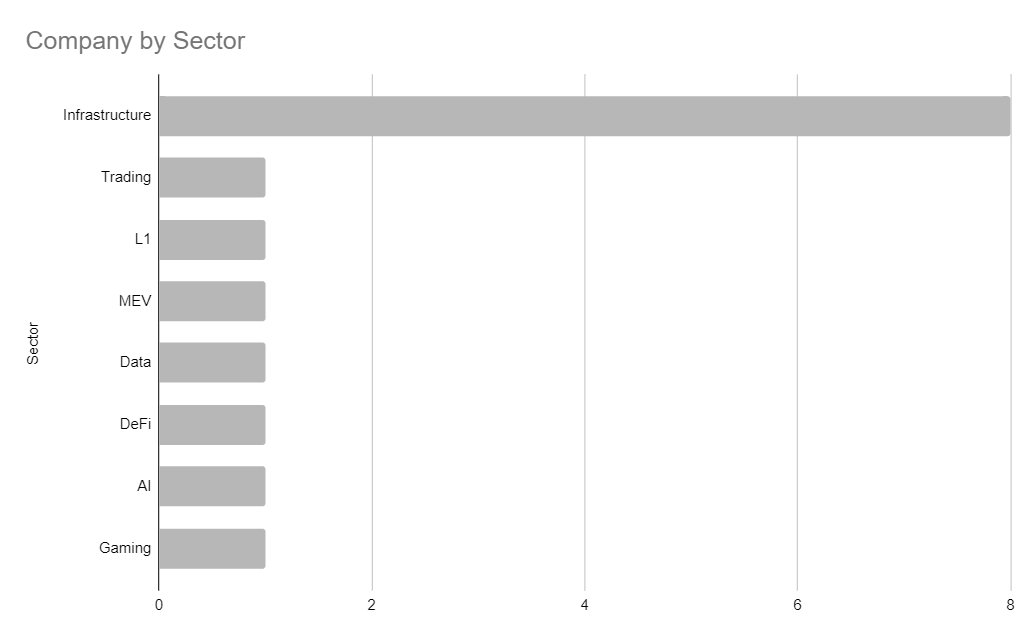

Below is a breakdown of the number of companies that fundraised by sector:

Infrastructure

Enso Finance is a unified DeFi platform that provides a comprehensive API for interacting with various DeFi primitives. It allows users to earn yield, trade, borrow, lend, and automate tasks through a single interface. On June 25th, Enso raised a Private round of $4.2 million from IDEO CoLab Ventures and Hypersphere Ventures.

Nubila is a global environmental network that uses DePIN and AI to enhance precise ESG data collection and analysis. It provides universal accessibility, seamless data integration, and a collaborative ecosystem where contributors earn $Nubi tokens for sharing ESG data. The project raised on July 1st a $2.5 million Private round led by IoTex, Boston Consulting, and Vechain, and followed by MH Ventures, Orange DAO, Future Money Group, SNZ Capital, Taisu Ventures, Kronos, and others.

MegaETH is a blockchain platform designed to offer high performance and scalability with over 100,000 transactions per second, sub-millisecond latency, and low transaction fees. It supports full EVM compatibility, enabling seamless global composability. MegaETH raised on June 27th a $20 million Seed round led by Dragonfly Capital and followed by Figment Capital, Folius Ventures, Robot Ventures, Tangent, Big Brain Holdings, Vitalik Buterin, and others.

Astria is a decentralized platform designed to simplify the deployment of rollups using a shared sequencer network. It offers fast, censorship-resistant block confirmations and ensures that all transaction data is stored on the base layer. The project raised on July 1st a Strategic $12.5 million round led by Placeholder and DBA, and followed by Figment Capital, 1kx, RockawayX, and Maven 11.

Covalent provides a modular data infrastructure and decentralized network for accessing and managing on-chain data. It supports over 200 blockchains, offering verifiable, structured data for developers and businesses. Covalent raised a Strategic $5 million round on June 26th led by RockTree Capital and followed by CMCC Global, Moonrock Capital, and Double Peak Group.

Conduit is a platform that enables rapid deployment and scaling of blockchain rollups. It offers modular, customizable rollup infrastructure with frameworks like Ethereum, OP Stack, Arbitrum Orbit, Base, and Celestia. On June 25th, Conduit raised a $37 million Series A round led by Paradigm and Haun Ventures, and followed by Robot Ventures, Credibility Neutral, Coinbase Ventures, and Bankless Ventures.

NovaNet is a modular ZKP incentive network that provides fast, privacy-preserving proofs for browsers, consumer devices, and blockchains. It optimizes decentralized proving with game-theoretic prover cooperation, enabling scalable, private, and verifiable computation. The project raised on June 25th a $3 million Seed round led by Finality Capital Partners, and followed by Arrington Capital, Avalanche Foundation, Builder Capital, and Caballeros Capital.

CARV is a modular data layer designed for gaming and AI applications. It provides scalable solutions to manage and analyze large datasets efficiently, integrating seamlessly with existing gaming and AI infrastructures. CARV raised $35 million in a Node Sale on July 2nd.

Trading

Crossover Markets operates CROSSx, an execution-only cryptocurrency electronic communication network (ECN) designed for institutional participants. It offers ultra-low latency and high throughput for fast trade executions, without providing custody or brokerage services. The company raised on June 26th a Series A round of $12 million led by Illuminate Financial, and DRW Venture Capital.

L1

Decent Land Labs develops protocols to enhance web3 interoperability and data permanence. They offer tools like WeaveVM for scalable EVM networks, MEM for serverless functions with permanent storage, Namespace for custom name services, and Ark Protocol for web3 identity management. On June 25th, Decent Land raised a $3 million Seed from Foresight Ventures, LD Capital, Big Brain Holdings, and Longhash Ventures.

MEV

Rebar Labs is developing MEV-aware infrastructure, products, and research for the Bitcoin ecosystem. They focus on enabling users and miners to navigate Bitcoin's emerging MEV landscape, supporting metaprotocols like Runes and BRC-20s. Rebar raised on June 27th a $2.9 million Seed round led by 6th Man Ventures and followed by ParaFi Capital, Arca, Moonrock Capital, and UTXO Management.

Data

Mamori is an AI-powered platform for risk intelligence and compliance monitoring in the Web3 ecosystem. It integrates data from both on-chain and off-chain sources to provide comprehensive risk analysis, real-time alerts, and automated compliance monitoring. Mamori raised on July 1st a $5 million Seed led by Blockchain Capital and followed by Velocity Capital, Web3.com Ventures, Grigore Rosu, Alex Watts, and others.

DeFi

Fenix is a DeFi platform within the XEN ecosystem that rewards users for staking tokens. It operates on principles of self-custody, transparency, and permissionless value exchange. Fenix raised on June 27th a $300k Seed led by Orbs and followed by HyperNest Angels, Lynex, Samurai Starter, and Pragma.

AI

ORA is a platform focused on building a next-generation communication protocol for Web3. It aims to enhance decentralized communication by providing secure, scalable, and efficient messaging solutions for blockchain ecosystems. Ora raised on June 26th a $20 million Series A round from Polychain Capital, HF0, HashKey Capital, and SevenX Ventures.

Gaming

Redacted raised a $10 million Private round on June 26th led by The Spartan Group and followed by Saison Capital, Animoca Brands, and P2 Ventures.