Crypto Fundraises | July 2nd - July 9th

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 15 funding rounds, collectively worth $208.95 million.

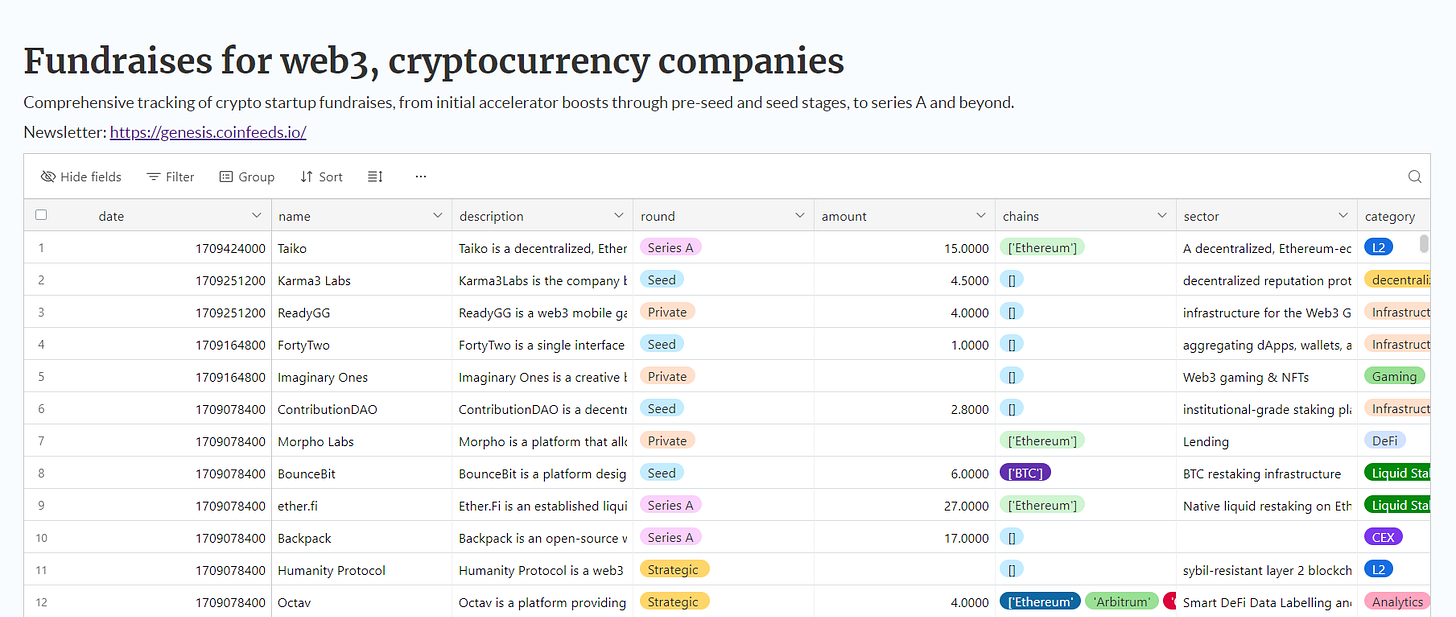

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

Below is a breakdown of the number of companies that fundraised by sector:

Infrastructure

CARV is a modular data layer designed for gaming and AI applications. It focuses on providing secure, scalable, and efficient data management solutions tailored to the unique needs of these industries. On July 2nd, CARV raised $35 million through a node sale.

SendBlocks is a blockchain data management platform that simplifies interaction with blockchains, reducing development efforts by up to 80% and time to market from months to weeks. It offers real-time risk mitigation, backendless notifications, and real-time balance updates for various apps. On July 2nd, SendBlocks raised an $8.2 million Seed led by Castle Island Ventures and followed by Pitango, Illuminate Financial, Laser Digital, and StarkWare.

Pi Squared (Pi2) offers a universal, verifiable computing platform for blockchain interoperability, enabling trustless remote computing, AI, and smart contracts across any blockchain or dApp. Utilizing Zero-Knowledge (ZK) proofs, Pi Squared ensures efficient, secure, and scalable connections between chains. Pi Squared raised a $12.5 million Seed on July 2nd that was led by Polychain Capital and followed by ABCDE, Bloccelerate, Generative Ventures, Robot Ventures, Samsung Next, and others.

Prodia offers an easy-to-use API for AI-powered image generation, enabling developers to add generative AI capabilities to their applications. The platform boasts rapid image creation, with over 400 million images generated and a two-second generation time. The project raised on July 2nd a $15 million Seed led by Dragonfly Capital and followed by HashKey Capital, Symbolic Capital, OKX Ventures, EV3, Artichoke, and others.

QED Protocol is a zk-Native blockchain designed to scale trustless computation and privacy for the next-generation internet. It offers horizontal scalability, supporting millions of concurrent users, and enables Web2 developers to write smart contracts in popular programming languages. QED Protocol raised a $6 million Seed round on July 3rd that was led by Blockchain Capital.

UniSat is a comprehensive platform for managing Bitcoin assets, offering services such as trading, inscribing, and managing digital assets. It features a wallet, a marketplace for trading Ordinals, Atomicals, and tokens like BRC-20 and ARC-20. On July 4th, UniSat raised a pre-Series A round led by Binance Labs.

RedStone is a modular oracle platform designed for DeFi and institutional use. It offers secure, flexible, and efficient data feeds across multiple blockchain networks including EVM and non-EVM chains, rollups, and appchains. RedStone raised on July 2nd a Series A round of $15 million led by Arrington Capital and followed by SevenX Ventures, IOSG Ventures, Spartan, Alchemy Capital, White Star Capital, Protagonist, gumi Cryptos, and others.

ETHOS is a social network focused on fostering meaningful connections and personal growth. It offers a platform for users to engage in deep conversations, share knowledge, and connect over shared interests and causes. On July 2nd, Ethos Network raised a $1.75 million round from Zeneca, Bharat Krymo, James Hall, 0xQuit, Tre, and other individuals.

AI

OpenLedger provides custom blockchain development and consulting services to businesses, leveraging popular blockchain platforms like Hyperledger, EOS, BitShares, and Ethereum. The company offers industry-specific solutions for sectors such as fintech, entertainment, and insurance. The company raised on July 2nd an $8 million Seed round led by Polychain Capital and Borderless Capital, and followed by Hash3, HashKey Capital, Mask Network, WAGMI Ventures, MH Ventures, and many others.

Sentient is an open AGI foundation focused on aligning AI innovations with community-driven contributions. It provides a platform for managing AI artefacts, utilizing blockchain protocols for AI exchange and usage tracking, and fostering a collaborative ecosystem for developing new foundational AI models. Sentient raised on July 2nd an $85 million Seed led by Pantera Capital and Framework Ventures, and followed by Robot Ventures, Delphi Ventures, and others.

Gaming

Cambria is developing a game inspired by Runescape, featuring on-chain stakes. The platform allows players to engage in a Duel Arena, where they can compete and stake assets. Built on the Blast blockchain, Cambria offers a blend of traditional gaming with blockchain technology. Cambria raised on July 2nd a $2.5 million Seed led by Bitkraft VC and 1kx.

Stablecoin

Ampleforth (AMPL) is a decentralized, algorithmic cryptocurrency designed to be a stable unit of account. Unlike traditional stablecoins, AMPL's price targets the CPI-adjusted dollar by automatically adjusting its supply based on demand, ensuring each AMPL equals one USD. Ampleforth raised a $1 million Strategic round on July 7th led by Coinbase Ventures.

RWA

Compute Labs is developing AI-Fi, a financial ecosystem for AI investments. It features the Compute Tokenization Protocol (CTP) for pricing compute assets and enabling staking, trading, and derivatives. Compute Labs raised on July 3rd a Pre-Seed round of $3 million led by Protocol Labs and followed by Blockchain Coinvestors, OKX Ventures, CMS Holdings, HashKey Capital, Amber Group, and others.

Liquid Restaking

Lombard Finance connects Bitcoin to the DeFi ecosystem through LBTC, a wrapped Bitcoin token. It enables users to leverage their BTC in various DeFi applications, such as lending, borrowing, and earning yields, without selling their assets. On July 2nd, Lombard raised a $16 million Seed round led by Polychain Capital and followed by BabylonChain, Inc., Dao5, Franklin Templeton, Foresight Ventures, Mirana Ventures, Mantle Ecosystem, and Nomad Capital.

DeFi

Plaza Finance is the first Layer-1 blockchain platform dedicated to programmable derivatives. It aims to create a community-owned platform for advancing decentralized finance, allowing users to create, manage, and trade various financial derivatives in a decentralized manner. On July 4th, Plaza Finance raised a Pre-Seed round led by Anagram and followed by Interlop Ventures, Cosmostation, and Skip.