Crypto Fundraises | February 27th to March 5th

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 21 funding round.

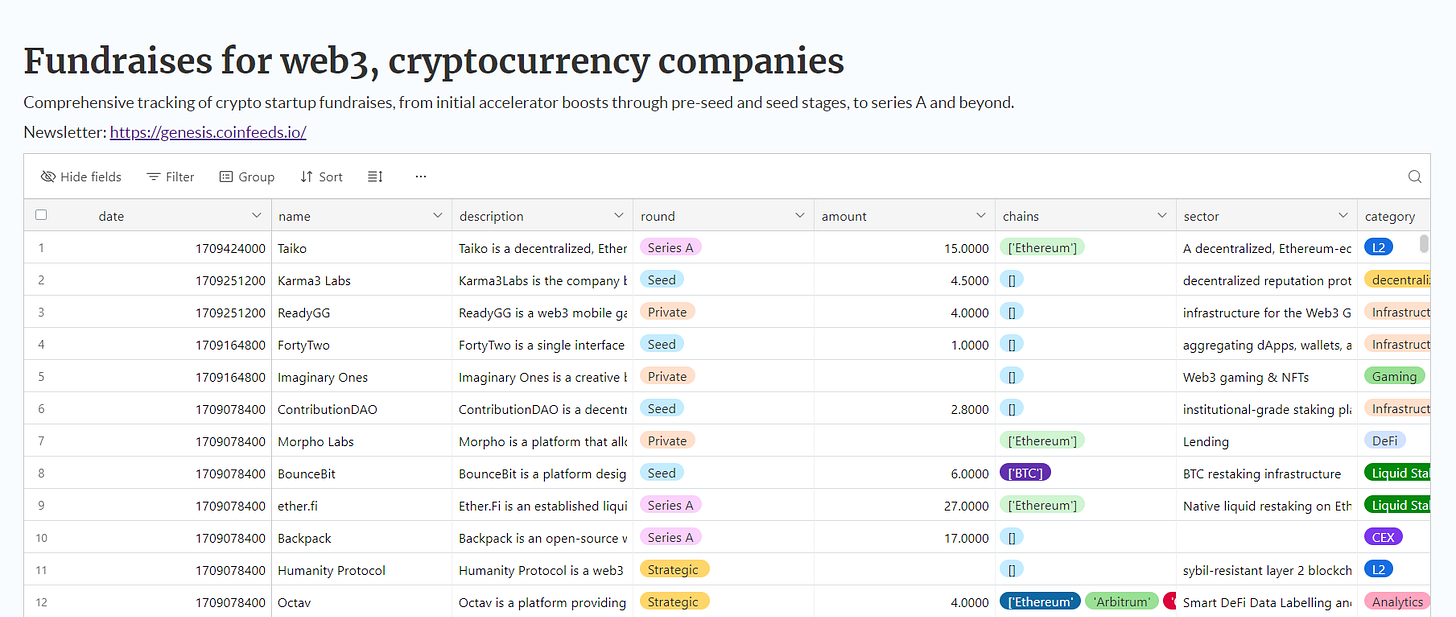

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

Below is a breakdown of the number of companies that fundraised by sector:

DeFi

BounceBit is a platform designed for BTC restaking, aimed at providing users the opportunity to earn a yield on their idle Bitcoin. The company raised on February 28th a Seed round of $6 million led by Breyer Capital and Blockchain Capital, and followed by Dao5, CMS Capital, Bankless Ventures, NGC Ventures, Matrixport, Primitive Ventures, Arcane Capital, IDG Capital, Nomad Capital, Bixin Capital, Geek Capital, DeFiance Capital, GMR, OKX Ventures, and many others.

Validation Cloud is a leading node and staking provider for institutions, specializing in Node API, staking, and Data-as-a-Service to connect enterprises to blockchain networks. It offers a high-performance, SOC2-compliant platform that facilitates access to web3 data globally. The project raised on February 27th a $5.8 million Seed round led by Cadenza Ventures and followed by Blockchain Founders Fund, BlockWall Digital, Bloccelerate, Side Door Ventures, Metamatic, GS Futures, and AP Capital.

Sphere is a platform designed to facilitate global access to stablecoins, aiming to improve the way value is transferred. It supports a variety of payment methods, including major card networks and bank transfers, across 120+ countries. Sphere raised on February 27th a Seed round of $2.8 million that was led by TCG Crypto and Jump Capital, and followed by Hudson River Trading, Big Brain Holdings, Solana Ventures, SteelDAO, SHV, Republic Capital, Cogitent Ventures, and many individual investors.

BabylonChain is a company that offers a unique Bitcoin staking protocol that enables Bitcoin holders to earn yields from their idle bitcoins securely, without requiring third-party trust or the need to bridge Bitcoin to any other chain. Users lock their bitcoins in a self-custodial manner, gaining rights to validate Proof-of-Stake (PoS) chains and earn yields in return. Babylon raised on February 27th a Private round led by Binance Labs.

Ether.Fi is an established liquid staking solution for Ethereum, enabling users to stake ETH and receive eETH, a restaked token that can be used within DeFi for maximizing returns. The company raised on February 28th a $27 million Series A round led by CoinFund and Bullish, and followed by Amber Group, Bankless Ventures, OKX Ventures, ConsenSys, Foresight Ventures, Fourth Revolution Capital, Punk Ventures DAO, White Star Capital, Relayer Capital, Collider Ventures, and others.

Morpho is a platform that allows users to earn by lending to Morpho Blue markets through MetaMorpho vaults. It features a user-friendly interface where users can connect their wallets to participate in lending, with additional tools and resources available for optimizing lending strategies. Morpho Labs raised on February 28th a Private round that was led by Pantera Capital.

Scallop is a money market built on Sui, focusing on institutional-grade quality, enhanced composability, and robust security. It optimizes models from Compound V3, Euler, and Solend V2, featuring a trilinear interest rate model, dynamic parameters, and a protected collateral vault. Scallop raised on March 3rd a Strategic $3 million round led by CMS and 6th Man Ventures, and followed by KuCoin Labs, Side Door Ventures, Oak Grove Ventures, Signum Capital, Blockchain Founders Fund, Cypher Capital, Mysten Labs, Kyros Ventures, 8186 Capital, 7UpDAO, LBank Labs, and other investors.

Infrastructure

FortyTwo is a single interface for the Interchain, simplifying the management and interaction with decentralized finance (DeFi). It offers a clear view of interchain portfolios, enabling users to connect multiple wallets, handle taxes, claim airdrops, find optimal swap rates, and earn the best yields. On February 29th, FortyTwo raised a $1 million Seed round led by LBank Labs and followed by Binary Builders, Dorahacks, Interop Ventures, Kahuna, Longhash Ventures, Public Works, Typhon Ventures, Brian Crain, Darren Li, Dean Tribble, Don Cryptonium, Eli Krenzke, and other individuals.

GEODNET is a blockchain-based RTK Network that aims to build the world's largest Real-Time Kinematics (RTK) network. It leverages decentralized principles (DePIN) to enhance location accuracy up to 100 times compared to standalone GPS, supporting autonomous systems with a combination of on-device sensors. On February 28th, Geodnet raised a $3.5 million Seed round led by North Island VC and followed by Borderless Capital, Modular Capital, Road Capital, Tangent, Reverie, Iotex, and JDI.

Initia is a company building a network for interwoven rollups, aiming to enhance the modular future of blockchain technology. It has been running on a closed testnet with a selection of Layer 2 teams and plans to unveil an incentivized testnet drop in Q1 2024, indicating a forward-looking approach to blockchain development. The company raised a $7.5 million Seed round on February 27th that was led by Delphi Digital and Hack VC, and followed by Cobie, DCF God, SplitCapital, Nascent, Figment Capital, a_capital, Big Brain Holdings, Nick White, and Smokey.

Karma3Labs is the company behind OpenRank, a decentralized reputation protocol aimed at enabling developers to create applications and manage communities with an open ranking and recommendation layer. The project raised a Seed round of $4.5 million on March 1st that was led by Galaxy Digital and IDEO CoLab Ventures, and followed by Spartan, SevenX Ventures, HashKey, Flybridge, Draper Dragon, Compa Capital, Delta Blockchain Fund, Andrew Hong, and Liang Wu.

Taiko is a decentralized, Ethereum-equivalent ZK-EVM rollup designed for maximum compatibility and a seamless developer experience. It emphasizes open-source code, available on GitHub under a permissive license, and supports decentralized and permissionless participation. Taiko raised on March 3rd a Series A round of $15 million led by Lightspeed Faction, Hashed, Generative Ventures, and Token Bay Capital, and followed by Wintermute, Presto Labs, Flow Traders, Amber Group, OKX, GSR, and WWVentures.

Security

CredShields is a next-generation security tools provider for Web3 applications, offering comprehensive security solutions across all stages of application development and post-deployment. It specializes in smart contract vulnerability scanning with its product SolidityScan, threat monitoring, and various security services including wallet, blockchain, web, and mobile application security, along with cloud infrastructure audits. CredShields raised on March 4th a Strategic $1 million round from Draper Associates.

Privasea is the world's first Fully Homomorphic Encryption Machine Learning (FHEML) inference network, providing a revolutionary solution to data privacy issues in AI. It offers encrypted machine learning inferences, allowing for the secure use of confidential datasets. Privasea raised on March 4th a $5 million Seed round from Binance Labs, MH Ventures, Gate Labs, K300, QB Ventures, Crypto TImes, Zakaria Awes, and Luke Sheng.

Metaverse

Imaginary Ones is a creative brand that blends art and technology, focusing on NFTs, digital fashion, and gaming applications. It is known for its vibrant and engaging digital collectibles, including the Genesis IO NFTs and collaborations like HUGO x IO fashion NFTs. The brand is set to expand its offerings with $BUBBLE Coin and an upcoming gaming app, IO Carnival. The company raised on February 29th a Private round from Cypher Capital, Animoca Brands, Eden Holdings, MH Ventures, Illuminati Capital, NxGen, Hercules Ventures, Andromeda Capital, PG Capital, and a series of individuals.

Digital Identity

Humanity Protocol is a web3 platform focused on digital identity, utilizing non-invasive biometrics and Proof-of-Humanity technology. It aims to create a decentralized network promoting personal identity ownership, equity, and inclusion. The protocol develops unique human authentication mechanisms for developers and offers users complete control over their data and identity. The project raised a Strategic round on February 28th from Hashed, CMCC Global, Cypher Capital, Foresight Ventures, and Mechanism Capital.

Data

Octav is a platform providing individuals with smart DeFi data labeling and analytics for cross-chain portfolio tracking. It automates portfolio labeling, profit & loss reporting, and tracking across chains, boosting portfolio performance through editable analytics. The platform calculates profit and loss for every transaction, supports customizable reports for tax season, and offers a comprehensive dashboard for monitoring DeFi investments. Octav raised on February 28th a Strategic $4 million round led by a "high net worth individual".

Governance

ContributionDAO is a decentralized hub designed for and by contributors within the Web 3.0 ecosystem. It functions as both a "Contribute-as-a-Service" and "Community-as-a-Service" platform, assisting partners in the development, expansion, and enhancement of their products, as well as building real communities, hosting events, and distributing contribution tasks. On February 28th, ContributionDAO raised a $2.8 million Seed round led by KASIKORN X Venture Capital and followed by Axelar, UMI, Connext, and Monad.

Gaming

ReadyGG is a web3 mobile gaming ecosystem that empowers developers, creators, and users with shared ownership via blockchain technology, a token economy, and cross-game NFT assets. It offers tools for launching new Web3 games, transitioning existing games to web3, and monetizing through Dev to Earn, Create to Earn, and Play to Own. On March 1st, ReadyGG raised a Private round of $4 million led by Delphi Digital and Momentum6, and followed by Merit Circle, ZBS Capital, Token Metrics Ventures, Purechain Capital, and Alex Becker.

Rewards

Stack is a platform that revolutionizes the concept of loyalty points by bringing them onto the blockchain. It provides simple tools for managing loyalty points programs, making it easier for users to integrate these programs into their applications with just a few lines of code. On March 4th, Stack raised a $3 million Seed round led by Archetype and followed by Coinbase Ventures, Scalar Capital, A.Capital, Balaji Srinivasan, Nadav Hollander, Henri Stern, Cooper Turley, and Colin Armstrong.

Wallets

Backpack is an open-source wallet on Solana, designed for securing NFTs and digital collectibles with features like NFT locking to prevent unauthorized access, spam filtering, staking with rewards, and customizable settings for privacy and personalization. It supports over 100 popular Solana NFT collections, enabling users to filter out spam, stake assets, and maintain privacy without KYC. Backpack raised on February 28th a Series A round of $17 million led by Placeholder and followed by Hashed, Robot Ventures, Wintermute Ventures, Amber, and Selini Capital.