Crypto Fundraises | August 20th - August 27th

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 22 funding rounds, collectively worth $145.3 million.

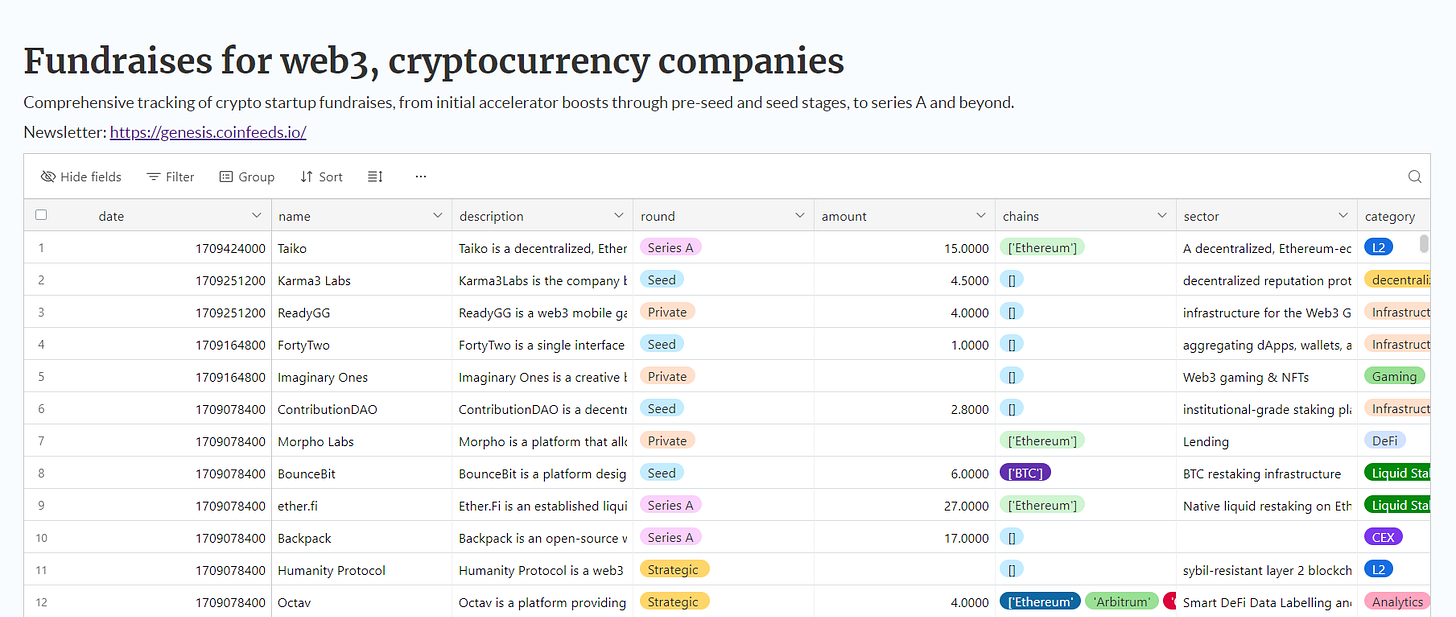

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

Below is a breakdown of the number of companies that fundraised by sector:

DeFi

BSX Exchange is a decentralized platform for trading, earning, and borrowing with best-in-class liquidity. BSX raised on Aug 21 a $4M Seed led by Blockchain Capital and followed by Bankless Ventures, NoLimit Holdings, Cadenza Ventures, Breed VC, Maelstrom, and others.

Vooi enables cross-chain trading across Perp DEXs with a unified interface. The platform supports trading on various blockchains. Vooi raised a Private round on Aug 22 led by Binance Labs.

Origami Network is a decentralized protocol on Ethereum for building online marketplaces. Origami raised on Aug 26 a $1.5M Seed from Ouroboros Capital, Good Partners, Fjord Foundry, Upside, TempleDAO, and many others.

Corn is an Ethereum L2 that uses a tokenized Bitcoin as its gas token and incorporates "Super Yield" to direct rewards back to users and protocols. BTCN is backed 1:1 by native Bitcoin. Corn raised a Strategic round on Aug 20 led by Binance Labs.

Credbull is the first licensed on-chain private credit fund, offering high fixed-yield structured products backed by real-world assets. Credbull raised on Aug 22 a $5.2M round led by GnosisDAO and followed by Outlier Ventures, HODL Ventures, XBTO Group, and several individuals.

AI

GenLayer is an AI-powered blockchain platform that enables smart contracts to use LLMs and access the internet for complex decision-making. The company raised on Aug 20 a $7.5M Seed led by North Island Ventures and followed by Node Capital, Arrington Capital, ZK Ventures, WAGMI Ventures, Blockbuilders, and Maelstrom.

Rivalz introduces an AI Intel Layer that powers an ecosystem of modular AI apps, focusing on data provenance for AI markets. They raised a $9M Private round on Aug 21 from Delphi Ventures, Zee Prime Capital, Caballeros Capital, D1 Ventures, Mask Network, GSR, and many others.

Aggregata is creating a decentralized ecosystem for data management, monetization, and AI development. It offers tools like GPT-to-Earn, where users can monetize ChatGPT conversations. They raised a Private round on Aug 22 led by Binance Labs.

Trading

PIP Labs is the company behind Story Protocol, a blockchain designed to tokenize and monetize intellectual property. On Aug 21, PIP Labs raised an $80M Series B round led by a16z crypto and followed by Polychain Capital and several individuals.

g8keep is set to offer a secure and transparent platform for launching and trading tokens, addressing the vulnerabilities in current systems. They raised a $1.25M Pre-Seed round on Aug 21 from Robot Ventures, Base Ecosystem Fund, The Huddle, Wassie Guild, echoxyz, Sappy Seals, Azuki, and many more.

Infrastructure

Stork is an open data marketplace aimed at overcoming the limitations of traditional blockchain oracles. It provides access to decentralized, reliable, and unique data. Stork raised on Aug 22 a $4M Seed round from Lattice, Faction, CMS Holdings, and Wintermute.

Chainbound develops blockchain infrastructure tools. Their products include a high-speed Ethereum network, a transaction dispatch interface, and a protocol for sub-second preconfirmations. Chainbound raised $4.6M Seed on Aug 28 led by Cyber Fund and followed by Maven 11, Robot Ventures, and Bankless Ventures.

Payments

Ark Labs is developing Ark, a Layer 2 protocol that scales Bitcoin for fast, low-cost payments. They raised a $2.5M Pre-Seed on Aug 22 led by Draper Associates and followed by Fulgur Ventures, Axiom Capital, and Stephen Cole.

Skyfire enables AI agents to autonomously manage identities, payments, and transactions in the AI economy. Skyfire raised a Seed round on Aug 21 from Circle Ventures, Ripple, Gemini, and Draper Associates.

Arch Finance offers diversified crypto investment products that allow users to invest in Bitcoin, Ethereum, digital dollars, and other cryptocurrencies without minimums. The company raised on Aug 22 a $5M Seed led by Morgan Creek Digital and Castle Island Ventures, and followed by Galaxy and BitGo.

Web3

Opinion Labs is building omni-chain social infrastructure that integrates with top social apps, valuing human opinions in the digital space. They raised on Aug 22 a Private round led by Binance Labs.

Digital Identity

zkMe is a zk-Identity Layer that creates Identity Oracles using ZKPs for secure, self-sovereign, and private credential verification. zkME raised a $4M Seed on Aug 20 led by Multicoin Capital and followed by OKX Ventures and Robot Ventures.

Gaming

Gamee connects gamers, brands, and Web3 projects through mobile gaming. As the largest gaming platform on Telegram, it leverages interoperability with Web3 partners like Polygon and Binance. They raised on Aug 21 a Strategic round led by Pantera Capital.

Liquid Restaking

SatLayer is a universal security layer powered by Bitcoin, designed to enhance the security of dApps by leveraging Bitcoin as collateral. They raised on Aug 22 an $8M Pre-Seed round led by Hack VC and Castle Island Ventures, and followed by Franklin Templeton, OKX Ventures, Mirana Ventures, Big Brain, Amber Group, and CMS Holdings.

Stablecoin

Ducat Protocol introduces UNIT, the first decentralized stablecoin native to Bitcoin's Layer 1. Ducat raised on Aug 23 a $1.25M Pre-Seed led by UTXO and followed by CMS, Bitcoin Frontier Fund, Aurion Capital, Marin Ventures, and others.

Social Platform

Sidekick Finance is a Web3 full-service consultancy that helps businesses transition to the Web3 ecosystem. The company raised a Private round on Aug 22 led by Binance Labs.

MEV

Sorella Labs develops fair, permissionless on-chain markets. Their products an open-source MEV explorer and a DEX with native MEV protection. The project raised on Aug 20 a $7.5M Seed led by Paradigm and followed by Uniswap Labs Ventures, Bankless Ventures, Robot Ventures, and Nascent.