Crypto Fundraises | April 9th - April 16th

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 21 funding round, collectively worth $419.7 million.

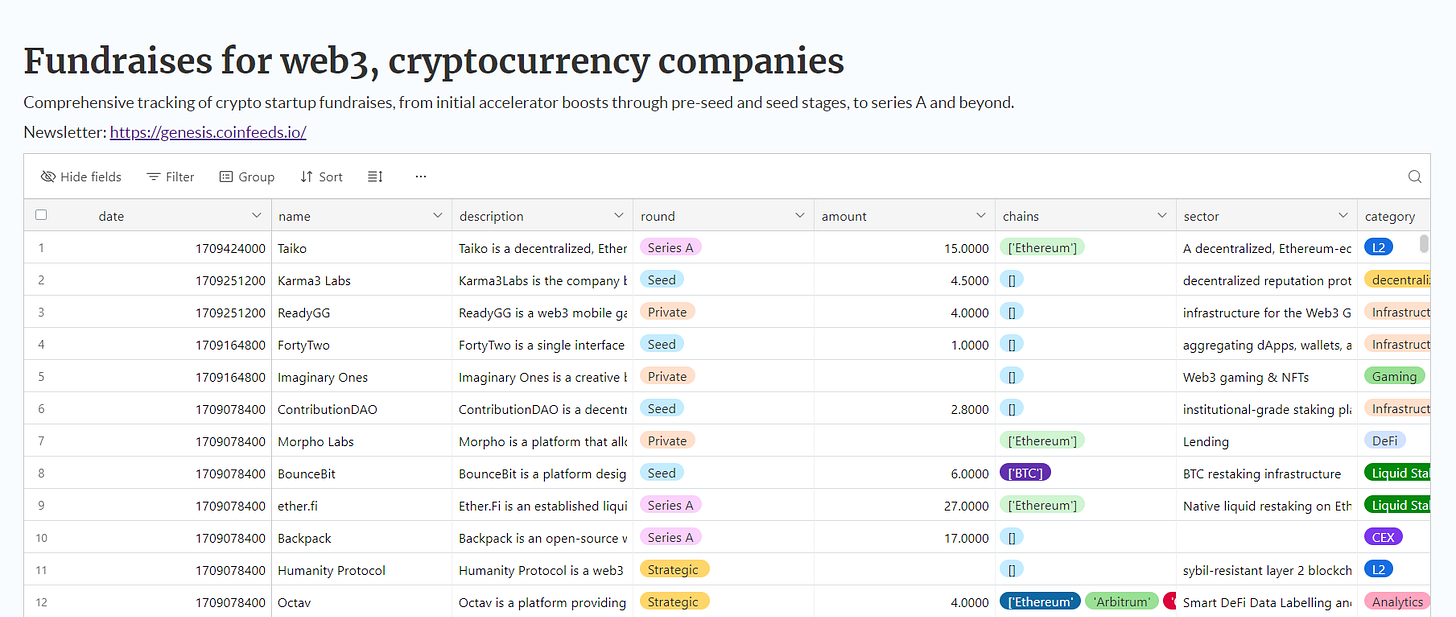

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

Below is a breakdown of the number of companies that fundraised by sector:

DeFi

OpenTrade is a platform designed for institutional DeFi, offering tokenized treasury bills and structured financial products backed by investment-grade assets. It provides access to on-chain structured financial products for treasurers, fintechs, and institutions. OpenTrade raised on April 9th a Seed round of $3.2 million from CSX, CMCC Global, Draper Dragon, Ryze Labs, and Plassa Capital.

Uplink is a platform designed to democratize internet access by enabling both individuals and businesses to contribute to and utilize a decentralized connectivity network, termed DeWi (Decentralized Wireless). It offers infrastructure providers a chance to be part of an expanding network, promising enhanced connectivity and tailored solutions. Uplink raised on April 11th a $10 million Seed round led by Framework Ventures and followed by Blockchange Ventures, Stratos, Outlier Ventures, and NxGen.lens.

Mayan is a cross-chain swap auction protocol that leverages Solana for executing swaps at optimal rates through a unique auction system. It allows users to swap tokens across different networks with a single click, without requiring gas fees on the destination chain. On April 11th, Mayan raised a $3 million Seed round led by 6th Man Ventures and Borderless Capital, and followed by Solana Ventures, Hash3, Big Brain Holdings, Arrington Capital, Cogitent Ventures, Syndicate by BOOGLE, and others.

Azuro is a decentralized ecosystem that supports a range of prediction and betting apps, offering various platforms for sports betting, gaming, and DeFi interactions. It includes non-custodial and custodial apps, emphasizing privacy, no-limit betting, and integration into popular communication platforms like Telegram. The company raised on April 11th a $3.5 million Private round from SevenX Ventures, Fenbushi Capital, Arrington Capital, Polymorphic Capital, Redbeard Ventures, and others.

Cove Finance is a DeFi platform focusing on yield automation and management. It offers products like Boosties, which allow users to earn enhanced yields on Yearn vaults through a unique liquid locker and staking system. Cove is developing an on-chain portfolio manager to simplify DeFi investment strategies, maximizing yields without the need for active management. Cove raised a $3 million Pre-Seed round on April 9th, led by Electric Capital and Accomplice, and followed by Robot Ventures, Daedalus, Richard Ma, Marc Boiron, Justin Reyes, and other people.

Infrastructure

Multisynq is a decentralized platform that enables real-time synchronization of digital content across the internet. It allows users to monetize their surplus internet bandwidth by becoming part of a low-latency network called Synqers, which supports developers in creating synchronized, low-cost applications and games. On April 12th, Multisynq raised a $2.2 million Seed round led by Manifold and followed by ARKN Ventures, Enigma Fund, AlphaCrypto Capital, Brian Johnson, gmoney, Sayinshallah, naniXBT, and 0xLawliette.

Aligned Layer is developing a universal verification layer for Ethereum, enhancing its capabilities for SNARK proof verification. This innovation, based on the EigenLayer, involves restaking and proof aggregation to enable cost-effective and efficient verification processes. Aligned Layer raised a $2.6 million Seed on April 13th, led by Lemniscap and followed by Bankless Ventures, Paper Ventures, StarkWare, 0(1) Labs, Sreeram Kannan, Daniel Lubarov, Wikeng Chen, and many other individuals.

Gull Network, operating on the Manta Network, offers a native DEX aimed at transforming DeFi with its user-friendly, codeless interface. It simplifies DeFi product management and token launches with customizable tokens and sniper-proof liquidity options, promoting open governance and seamless decentralized operations. On April 13th, Gull Network raised a Private $1.6 million round led by OZARU Ventures and followed by GBV Capital, MH Ventures, Banter Capital, Asteroid Capital, Andromeda Capital, Momentum 6, Maven Capital, SkyVision Capital, and Boxmining.

Alpen Labs is a platform that develops modular rollup layers for Bitcoin using zero-knowledge cryptography, aimed at increasing financial access and scalability while leveraging Bitcoin's security features. On April 10th, Alpen raised a $10.6 million Seed round led by Ribbit Capital and followed by Castle Island Ventures, Geometry Research, Village Global, StillMark, Paxos, Robot Ventures, Axiom, John Pfeffer, Charlie Songhurst, Ben Davenport, and others.

Liquid Staking Protocol

YieldNest is a platform that enhances Ethereum's economic security by providing higher yields through liquid restaking of ETH. It offers a next-gen DeFi solution that allows users to earn increased returns on their Ethereum holdings. YieldNest raised on April 15th a $5.2 million Private round from Faculty Group, Backed, Loi Luu, Winthorpe, C2tP, Michael Egorov, Steven Kokinos, 0xPims, Allen Day, Martin Krung, and others.

BounceBit is a platform that introduces a BTC Restaking chain, aiming to enhance Bitcoin yield opportunities through a unique dual-token staking system. It combines DeFi and CeFi strategies to generate yields both on-chain and off-chain, maintaining full EVM compatibility to integrate DeFi liquidity with the Bitcoin ecosystem. The project raised on April 11th a Private round led by Binance Labs.

L1

Monad is a Layer 1 smart contract platform that enhances Ethereum's capabilities by offering pipelined transaction execution. It aims to significantly increase scalability with 10,000 transactions per second and a 1-second block time. On April 9th, Monad raised a $225 million round led by Paradigm and followed by Electric Capital, Coinbase Ventures, eGirl Capital, Castle Island Ventures, Greenoaks Capital, Rune Christensen, Robinson Burkey, Mert Mumtaz, and other individuals.

Berachain is a high-performance, EVM-compatible blockchain that leverages a Proof-of-Liquidity consensus mechanism. It integrates DeFi components like AMMs, perpetuals, and lending directly into its architecture, enhancing liquidity and network security by aligning validator incentives with liquidity providers. Berachain raised another round on April 12th, this time a Series B of $100 million led by Brevan Howard Digital and Framework Ventures, and followed by Polychain, HackVC, Tribe Capital, Samsung Next, Laser Digital, Hashkey Capital, Nomad Capital, and many others.

AI

Sortium is an AI-powered platform that assists in creating and modifying professional 3D assets like textures, items, skins, levels, and characters. It integrates seamlessly into various 3D software, game engines, and UGC platforms, allowing creators to maintain control over their content. Sortium raised on April 11th a Seed round of $4 million led by Signum Capital and followed by ARK Investment Management, IDG Blockchain, IVC, Polygon Ventures, and 188 S Group AG.

Gaming

Avalon is an AI-powered universe where players can explore expansive MMO worlds and the tactical depth of tabletop RPGs. It features player-created stories and worlds, integrated into the main game to evolve the shared universe continuously. The game supports PC, consoles, and web platforms, targeting adults with a mature rating. Avalon raised on April 15th a Private $10 million round led by Bitkraft VC and Hashed, and followed by Coinbase Ventures, Spartan Capital, Foresight Ventures, LiquidX, Momentum 6, Sancor Capital, Spirit DAO, Circus, and many others.

Social Platform

Tomo is an all-in-one Web3 social wallet that transforms users' online presence into a universal hub for genuine, spam-free interactions and financial incentives. It allows direct connections with creators, private discussions, and exploration of digital art through Tomoji. Users can earn Tomo Points by actively participating. The project raised on April 10th a $3.5 million Seed round led by Polychain and followed by ConsenSys, Symbolic Capital, OKX Ventures, Nomad Capital, Story Protocol, Dao5, KuCoin Ventures, and HTX Ventures.

Analytics

Sapien specializes in enhancing large language models through high-quality data labeling and human feedback. It offers services across various industries, supporting the customization and scalability of data labeling processes. Sapien raised on a $5 million Seed round on April 10th from Primitive Ventures, Animoca Ventures, Ravikant Capital, and Yield Guild Games.

DEX

Stream Protocol is a DeFi super app that introduces capital-efficient financial products merging traditional and decentralized finance strategies. It offers innovative non-directional trading strategies to deliver high yields on popular assets like USDC, ETH, and BTC. Stream Trading raised a $1.5 million Seed round that was led by Polychain.

L2

Mezo is a platform that enhances decentralized trading by combining high liquidity and low transaction slippage. It integrates features typically found in centralized exchanges with the benefits of decentralized finance, providing tools for liquidity provision and yield farming. The company raised on April 9th a $21 million round led by Pantera Capital, and followed by Multicoin Capital, Hack VC, ParaFi Capital, Nascent, Draper Associates, Primitive Ventures, Asymmetric Ventures, Dan Held, and DCF God.

RWA

Zoth is integrating traditional finance with blockchain technology, providing a platform for tokenizing and creating liquidity for real-world assets on-chain. It offers institutional-grade fixed income products through stablecoins, allowing access to assets like trade finance receivables and government bonds. Zoth raised on April 10th a Seed round of $2.5 million led by Blockchain Founders Fund and followed by Borderless Capital, Mindfulness Capital, YAP Capital, Momentum 6, Singularity DAO, Aztlan Capital, and others.