Crypto Fundraises | April 30th - May 7th

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 16 funding rounds, collectively worth $205.4 million.

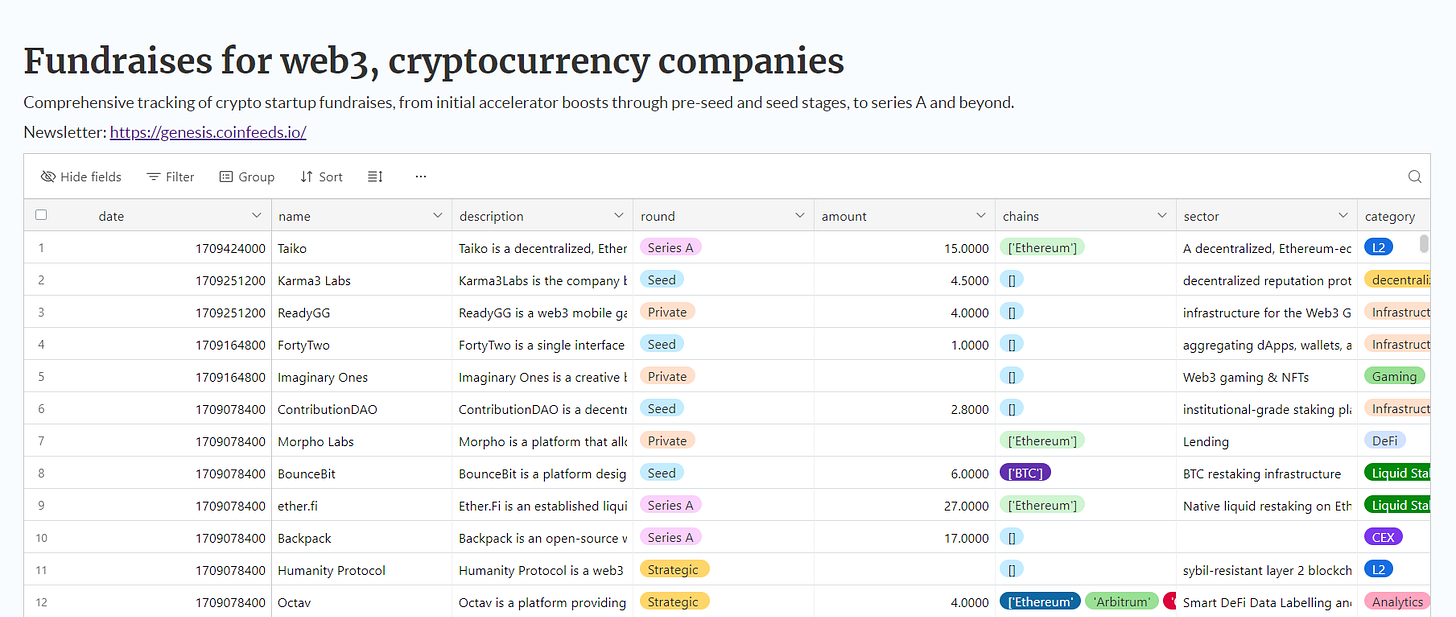

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

Below is a breakdown of the number of companies that fundraised by sector:

L1

Mitosis is an Ecosystem-Owned Liquidity (EOL) Layer 1 blockchain designed to enhance DeFi LP experiences. It introduces economies of scale to asset management and empowers liquidity providers with increased bargaining power. On May 2nd, Mitosis raised a $7 million Seed round led by Amber Group and Foresight Ventures, and followed by Big Brain Holdings, Folius Ventures, CitizenX, GSR, Cogitent Ventures, and others.

Crestal is a dynamic modular services platform designed for web3 builders. It enables the discovery, deployment, and upgrade of modular services through decentralized providers tied to a verifiable Proof of Performance. On May 3rd, Crestal raised a $2 million Pre-Seed round from LIF, Cogitent Ventures, Kyros Ventures, Veris Ventures, SMAPE Capital, MH Ventures, Layer Labs, and others.

TON is a decentralized and self-governing blockchain network developed with the technology designed by Telegram. It enables users to send digital dollars, manage tokens, and engage in DeFi with low fees and high security. The company raised a Secondary Market round on May 2nd led by Pantera Capital.

Liquid Staking

MilkyWay is a liquid staking protocol specifically designed for the Celestia blockchain. It allows users to stake TIA tokens, securing the Celestia network while earning staking rewards. The staked tokens are represented by milkTIA, which can be used across various DeFi platforms. The company raised on April 30th a $5 million Seed round from Mustafa Al-Bassam, Hack VC, Longhash Ventures, Crypto .com Capital, BatuX, YQ, Upnode, Polychain, Binance Labs, and others.

Bedrock is a multi-asset liquid restaking protocol that allows users to restake various cryptocurrencies like Ethereum, Bitcoin, and IoTeX on its platform. It facilitates instant liquidity, enabling the earning of native rewards through DeFi collaborations like EigenLayer and Babylon. Bedrock raised on May 2nd a Seed round led by OKX Ventures, LongHash, and Comma3 Ventures, and followed by Waterdrip Capital, Amber, Arche Fund, WhaleGround, LBank Labs, and Fisher Yu.

Social Platform

Airstack is a platform designed to enhance the capabilities of the Farcaster social network by providing middleware and APIs. It allows users to seamlessly integrate various on-chain activities and social interactions like casting, liking, and following into their applications. Airstack raised a Seed round of $4 million on May 2nd led by Red Beard Ventures, and followed by Superlayer, Polymorphic Capital, Superscrypt, Delta Blockchain Fund, CSP DAO, Promal Capital, and others.

Kiosk is a Farcaster client that integrates social media with onchain commerce. It enhances user interaction by enabling one-click NFT minting, asset discovery, and purchase directly from social feeds. The platform also facilitates the formation of token-powered community channels. Kiosk Social raised a $10 million Seed round on May 2nd that was led by Electric Capital and followed by a16z crypto, USV, and Variant.

RWA

Securitize is a platform that modernizes the trading and management of digital asset securities. It offers a fully digital, regulatory-compliant framework for issuing and managing digital securities, facilitating investment in alternative assets. Securitize raised on May 1st a Strategic $47 million round led by BlackRock and followed by Hamilton Lane, ParaFi Capital, Tradeweb Markets, Aptos Labs, Circle Ventures, and Paxos.

L2

Optimism is a Layer 2 scaling solution for Ethereum that focuses on low-cost and high-speed Ethereum transactions. It uses Optimistic Rollups to enable faster and cheaper transactions while maintaining security aligned with Ethereum's mainnet. Optimism raised on April 30th a Private token sale round of $90 million that was led by a16z.

Gaming

Blade DAO is a gaming-focused DAO designed to foster an ecosystem for blockchain games. It operates with the unique approach of integrating game development within a DAO structure, allowing community members to directly participate in governance and decision-making. Blade Games raised a $2.4 million Seed round on May 1st led by PTC Crypto and IOSG Ventures, and followed by Bonfire Union Ventures, Animoca Ventures, Mantle Network, Formless Capital, and others.

DEX

X10 Exchange is a cryptocurrency trading platform offering advanced trading features like up to 50x leverage, fast order execution, and diverse market access. It emphasizes security through self-custody and Zero Knowledge Proofs, ensuring transparency and fairness in trading. The company raised on April 30th a $6.5 million Seed round from Tioga Capital, Semantic Ventures, Cherry Ventures, StarkWare, and others.

Infrastructure

EYWA is a pioneering platform in web3 interoperability, offering solutions such as the Consensus Bridge and CrossCurve protocol. It ensures secure transactions across multiple protocols and addresses liquidity fragmentation between chains. The project raised on May 3rd a Seed round of $7 million led by Michael Egorov and followed by Fenbushi Capital, GBV Capital, Big Brain Holdings, Marshland Capital, and Mulana Capital.

Web3

Paragraph is an all-in-one publishing and newsletter platform that supports content creators in monetizing their work through subscriptions, collectible content, and crypto payments. It features an AI-powered writing assistant, customizable community and newsletter theming, and advanced analytics. The project raised a $5 million Seed round on May 2nd led by USV and Coinbase Ventures.

DAO

Agora is a governance platform designed for blockchain protocols, offering an end-to-end system to manage onchain governance without coding. It assists in the progressive decentralization of projects while managing risks and promoting community-led growth. Agora raised on May 1st a $5 million Seed round led by Haun Ventures and followed by Seed Club, Coinbase Ventures, Sina Habibian, Balaji Srinivasan, Credibly Neutral, Tim Beiko, and others.

Perpetuals

Baxus is a marketplace that specializes in peer-to-peer trading of premium spirits. It allows users to buy and sell high-quality, often rare alcoholic beverages such as whiskeys, rums, and other spirits. On May 1st, Baxus raised a $5 million Seed round led by Multicoin Capital and followed by Solana Ventures, FJ Labs, Narwhal Ventures, Alex Kehaya, Regan Bozman, Mike Zajko, and other individuals.