Crypto Fundraises | April 23rd - April 30th

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 12 funding rounds, collectively worth $115 million.

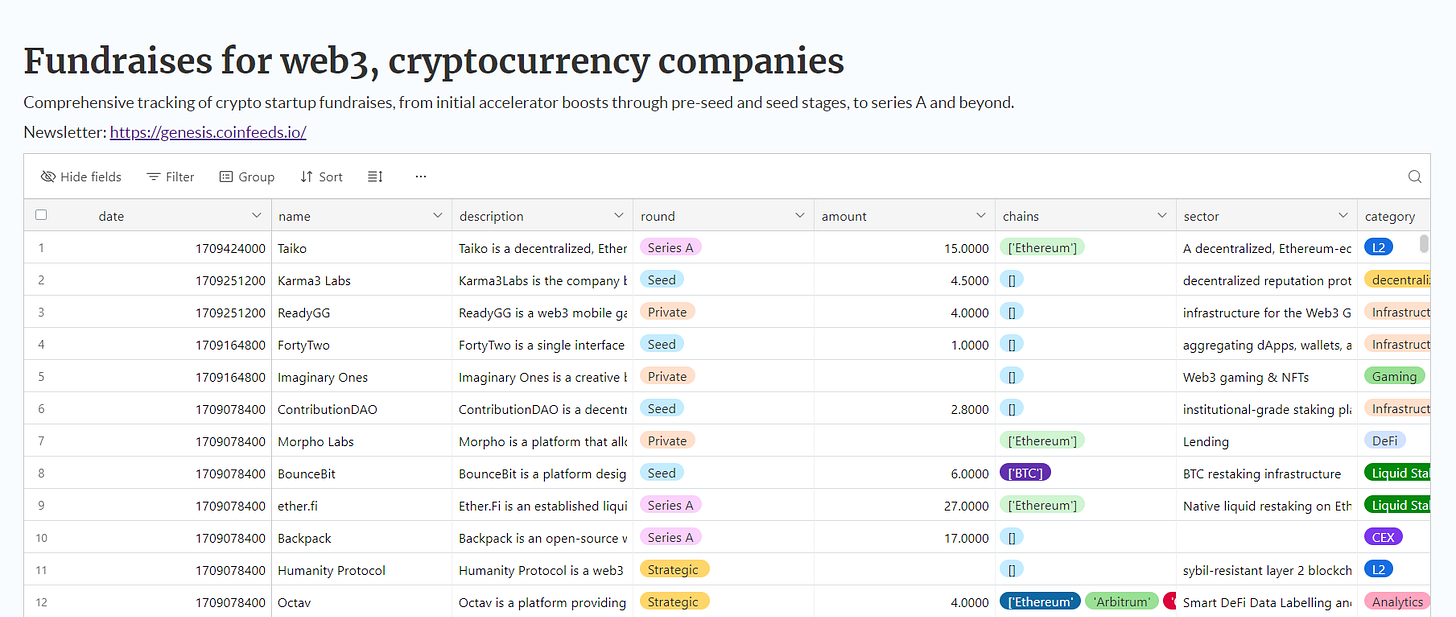

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

Below is a breakdown of the number of companies that fundraised by sector:

Infrastructure

Aligned Layer is a proof verification layer built on top of EigenLayer for Ethereum. It utilizes restaking and proof aggregation, enabling cost-effective verification of any SNARK proof. Aligned Layer aims to enhance Ethereum's ZK capabilities, supporting various proof systems and expanding the ecosystem for trustless applications. On April 25th, Aligned Layer raised a $20 million Series A round led by Hack VC and followed by Dao5, L2 Iterative Ventures, Nomad Capital, Finality Capital Partners, Symbolic Capital, Theta Blockchain Ventures, J17 Capital, and others.

Hinkal is a privacy-focused platform that facilitates confidential blockchain transactions and operations. It supports confidential token vesting, private swaps between cryptoassets, and anonymous staking/farming on popular DeFi platforms. Hinkal ensures transaction privacy through shielded addresses and relayers, offering tools for individuals and institutions to execute DeFi strategies without public traceability. The project raised a $1.4 million Strategic round on April 26th led by SALT and followed by Draper Associates, SNZ Capital, and Peer Venture Partners.

Turnkey is a platform that provides scalable and secure wallet infrastructure for crypto products. It allows users to create and manage thousands of non-custodial wallets across blockchains, sign transactions, and enforce security policies through a simple API. The company raised on April 23rd a $15 million Series A round led by Faction and Galaxy, and followed by Sequoia Capital, Coinbase Ventures, Alchemy, Figment Capital, Mirana Ventures, Anagram, TrueBridge, Asymmetric, Variant, and Gemini.

Holograph is a platform that facilitates the creation of omnichain tokens, allowing asset issuers to mint tokens that are interoperable across multiple blockchains. By using Holograph, users can mint tokens that maintain the same contract address across different chains, preserving fungibility. On April 29th, Holograph raised a Strategic $11 million round led by Mechanism Capital and Selini Capital, and followed by Arca, Northrock Capital, Courtside Ventures, and Hartmann Capital.

Movement is a network of modular move-based blockchains focused on enhancing security, performance, and user experience in decentralized networks. Their mission is to foster a global community of Move builders collaborating to achieve these goals. Movement Labs raised on April 26th a $38 million Series A round led by Polychain and followed by Hack VC, Placeholder, Archetype, Maven 11, Robot Ventures, Figment Capital, Nomad Capital, Bankless Ventures, and others.

Gaming

Tevaera is a web3 gaming ecosystem that offers a platform for developers to build and monetize blockchain-based games. It integrates various blockchain functionalities to enhance gaming experiences, such as tokenized game assets and decentralized governance, aiming to create a community-driven environment. Tevaera raised a $5 million Seed & Private round on April 24th that was led by Laser Digital and followed by HashKey Capital, Fenbushi Capital, Matter Labs, Draper Dragon, Crypto.com Capital, Cogitent Ventures, and many others.

InfiniGods is a blockchain-based gaming platform that focuses on mythology-themed games integrated with NFTs. It offers players the ability to own, trade, and leverage in-game assets across various mythological worlds, enhancing both gameplay and financial incentives. On April 26th, InfiniGods raised a Series A round of $8 million that was led by Pantera Capital.

AI

Prime Intellect is a platform aimed at democratizing AI development by commoditizing compute resources and collective intelligence. It facilitates the development, training, and scaling of AI models by aggregating global compute resources for efficient decentralized training. Prime Intellect raised on April 23rd a $5.5 million Seed round led by Distributed GLobal and CoinFund, and followed by Compound, Collab+Currency, Protocol Labs, Clem Delangue, Dylan Patel, Riva Tez, and many other individuals.

Perpetuals

NATIX Network is a platform designed to create a decentralized, dynamic map of the world using AI-powered cameras integrated across various devices like smartphones and vehicles. It enables users to contribute data by mapping their surroundings, which can then be monetized through a marketplace. Natix raised on April 26th a $4.6 million Strategic round led by Borderless Capital and Tioga Capital, and followed by Escape Velocity, Moonrock Capital, Cogitent Ventures, Big Brain Holdings, Laser Digital, WAGMI Ventures, and others.

Liquid Restaking Protocol

Chakra is a zero-knowledge (ZK) proof-based protocol designed to facilitate Bitcoin restaking. It enables secure, self-custodial staking of Bitcoin through ZK proofs, ensuring that users' Bitcoins never leave their wallets. The platform allows these staking proofs to be verified on various Proof of Stake blockchains, including Bitcoin Layer 2 solutions. Chakra raised on April 26th an undisclosed round from StarkWare, ABCDE, Bixin Ventures, Coinsummer, Cogitent Ventures, Trustless Labs, and XingKong.

DeFi

OpenDelta is a financial platform that offers a delta-neutral, yield-bearing synthetic dollar, which is powered by Bitcoin derivatives. It aims to provide a stable investment vehicle on the Runes network by allowing users to mint USDO (their synthetic dollar) or provide liquidity to the platform. The company raised on April 26th a $2.5 million Pre-Seed round led by 6th Man Ventures.

DEX

LazyBear is a web3 crypto trading platform designed to simplify cryptocurrency trading with zero thresholds and industry-low fees. With a 24-hour trading volume surpassing 802 million USDT and over 373,000 total trading users, LazyBear boasts accessibility and liquidity. On April 29th, LazyBear raised a Strategic $4 million round from Gogeko Labs, DWF Labs, Shadow labs, Salad Labs, Bees Network, Rei Network, IBIT, Crypto Bullish, and others.