Crypto Fundraises | April 16th - April 23rd

Welcome to the Coinfeeds Weekly Fundraising Report! We’re back at it this week, having found 19 funding rounds, collectively worth $112.7 million.

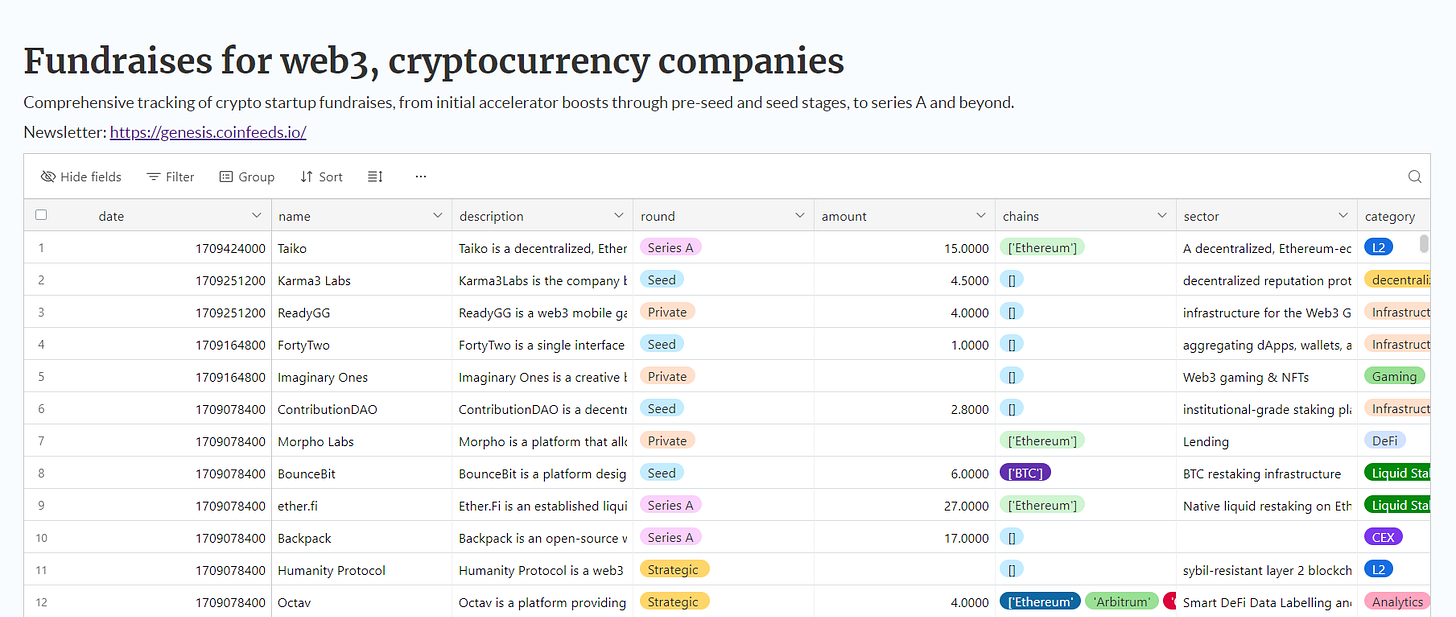

Here is the complete, newly published database featuring all of the fundraised companies we’ve found since the launch of this newsletter:

Crypto Startup Fundraises

Below is a breakdown of the number of companies that fundraised by sector:

Infrastructure

Nebra is a platform dedicated to advancing zero-knowledge proofs (ZKP) technology. It focuses on Universal Proof Aggregation (UPA), which significantly lowers the on-chain verification costs and enhances interoperability across different blockchains. Nebra aims to bring ZKP to a broader audience by aggregating proofs from any circuit. On April 17th, Nebra raised a Pre-Seed & Seed round of $4.5 million led by Nascent and Bankless Ventures, and followed by Tim Beiko, Kartik Talwar, Nick White, Sandy Peng, and Haichen Shen.

Ord.io is a comprehensive Ordinals Explorer that provides a platform for users to explore and interact with various types of inscriptions including images, GIFs, text, videos, and more on the Bitcoin blockchain. On April 17th, Ord raised a $2 million Pre-Seed round led by Bitcoin Frontier Fund and Sora Ventures, and followed by Eden Block, Arca, Longhash Ventures, Daxos Capital, Portal Ventures, and many others.

Othentic is a platform designed to build and scale distributed systems within shared security environments. It provides an extensive library of components like decentralized RPC, oracles, and AI inference networks to help users create stateless or stateful rollups. Othentic raised on April 22nd a $4 million Seed round led by Fidelity Capital Partners and Breyer Capital, and followed by Coinbase Ventures, Collider, Bankless Ventures, Robot Ventures, Hashkey Capital, Everstake, PunkDAO, and others.

Zeko is a decentralized, zero-knowledge, cross-chain scaling protocol built on the Mina protocol, designed to empower developers in fields such as finance, AI, gaming, and the internet. It focuses on enhancing decentralized trust and scalability across multiple blockchain ecosystems. Zeko raised on April 17th a Pre-Seed round of $3 million led by UOB Venture Management, Signum Capital, and YBB Capital, and followed by Autonomy Capital, Cogitent Ventures, GBV, Tenzor Capital, 3Commas Capital, ArkGrow, Avid3, Cryptonauts, and others.

DEX

Crypto Valley Exchange (CVEX) introduces a novel DeFi derivatives trading platform that seamlessly integrates futures and options trading for crypto and commodities. Developed by Tacans Labs in Switzerland, CVEX offers unique features such as multichain support from day one, over 1000x leverage, and real-time VaR-based portfolio management. The company raised on April 16th a Pre-Seed & Seed round of $7 million led by Fabric Ventures and Kyber Capital Crypto Fund, and followed by AMDAX, Wave Digital Assets, FunFair Ventures, Seier Capital, Saxon, and Five T Group.

Runes DEX is a decentralized exchange focused on enabling the trading of NFTs and digital assets within the Ordinals ecosystem on the Bitcoin blockchain. It allows users to buy, sell, and trade various types of digital inscriptions directly. The project raised on April 18th a $2 million Seed round led by Kenetic Capital and followed by Mechanism Capital, Auros Ventures, The Future Fund, Boosty Labs, Pascal Gauthier, 0xMaki, and AOI.

Aark Digital introduces a unique perpetual DEX designed to amplify stETH yields, featuring no gas fees, no open interest cap, and minimal slippage. It is the world's first such platform to facilitate enhanced yield opportunities for traders, focusing on seamless stETH staking rewards, trading fee rewards, and leveraged liquidity provisions. The project raised on April 17th a $6 million Seed round from Hashkey Capital, OKX Ventures, Dephi Digital, Big Brain Holdings, Arrington Capital, Morningstar Ventures, Black Dragon, Apollo Crypto, Skyland Ventures, and others.

Thruster is a yield-first decentralized exchange (DEX) on the Blast network, designed to cater to builders, yield seekers, and traders. It offers a suite of liquidity tools and native yield mechanisms to enhance trading and earning opportunities. Thruster raised a $7.5 million Seed round on April 18th led by Pantera Capital and followed by OKX Ventures, Mirana Ventures, ParaFi Capital, Dewhales Capital, Santiago R Santos, Mr. Block, and others.

Stablecoin

Usual Labs is the company behing USD0, a new USD-stablecoin backed by real-world assets (RWAs), designed to redefine user participation in fiat-backed currencies. This innovative DeFi stablecoin allows users to own a stake in their stablecoin issuer, promising a significant shift in how users interact with and benefit from financial assets. Usual raised on April 17th a Strategic $7 million round led by IOSG Vetures and Kraken Ventures, and followed by GSR, Mantle Network, Flowdesk, StarkWare, Avid3, Bing Ventures, Breed VC, Hypersphere, Kima Ventures, Psalium, Public Works, and others.

Lambda Finance enables Bitcoin holders to mint BTCUSD stablecoins against their Bitcoin holdings, allowing them to access DeFi earning opportunities while maintaining exposure to Bitcoin's price movements. On April 19th, Lambda Finance raised an Angel Round of $1.8 million from Hashcow Group, The A-team, AlladinDAO, Michael Egorov, Mr. Block, Threshold Network, and others.

L2

Merlin Chain is an innovative Layer 2 solution on the Bitcoin network, focusing on unleashing Bitcoin's potential by supporting native L1 assets, users, and protocols. It offers low fees, high scalability, and is EVM-compatible, enhancing transaction liquidity and processing. Merlin raised on April 17th a Private round led by The Spartan Group and Hailstone Labs, and followed by Amber Group, Presto Labs, and IOBC Capital.

Saakuru Labs introduces a consumer-centric Layer 2 protocol offering zero transaction fees, built to enhance blockchain accessibility and efficiency. Its Developer Suite allows rapid integration of complex digital products to Web3 within a day. The company raised a $2.4 million Private round on April 16th led by Based VC and Arc Community, and followed by Kyber Network, PG Capital, Rarible, Decubate, Wizard Capital, OIG Capital, Uptrend, Calib3r, BCW Group, Arclight Games, and others.

DePIN

SendingNetwork is a communications platform designed for Web3, offering exclusive private messaging and streaming services. It aims to bring blockchain accounts closer together by providing high-performance, privacy-focused, and secure social features. On April 16th, SendingNetwork raised a Seed+ round of $7.5 million from Nomad Capital, Symbolic Capital, Balaji Srinivasan, Web3[.]com Ventures, Galxe, SWC Global, and Gabby Dizon.

Liquid Staking Protocol

Puffer Finance is a decentralized finance platform that supercharges Ethereum liquid staking with innovative technology. It allows users to stake ETH, receive Puffer's native Liquid Restaking Token (pufETH), and boost their rewards through advanced DeFi integrations. Puffer raised on April 16th an $18 million Series A round led by Brevan Howard Digital and Electric Capital, and followed by Coinbase Ventures, Kraken Ventures, Lemniscap, Franklin Templeton, Fidelity, Mechanism Capital, and others.

Gaming

Uncharted is a GameFi platform that merges gaming with blockchain technology, offering players the ability to earn rewards through strategic gameplay. It features a variety of games where players can act as mob bosses or participate in PvP battles, earning and trading in the platform’s universal token. The company raised on April 22nd a $1.7 million Seed round led by Shima Capital and followed by Liquid X Ventures, Spartan Capital, D64 Ventures, Double Peak, Devmons, Trinity Labs, Flying Falcon, 32-bit Ventures, and others.

DeFi

Centrifuge is a platform that brings real-world assets onto the blockchain, making financial products more accessible and efficient. It provides transparency by bringing the entire capital structure, securitization, and servicing of debt facilities onchain. Centrifuge raised a $15 million Series A round on April 17th led by ParaFi Capital and Greenfield Capital, and followed by Edessa Capital, Scytale, ProtoCap, Bloccelerate, Gnosis, Skynet Trading, Stake Capital, Borderless Capital, and others.

Social Platform

Only1 is a membership-based social platform built on Solana, allowing creators to earn and engage with fans in new ways. Creators can monetize their content by launching digital collectibles called Passes, offering exclusive access to fans who purchase them. On April 22nd, Only1 raised a Strategic $1.3 million round led by Newman Group and followed by Folius Ventures, Modular Capital, PetRock Capital, Thiccy, Chumbawamba, and other individuals.

L3

Shiba Inu raised a $12 million Pre-Seed & Seed round from Polygon Ventures, Mechanism Capital, Big Brain Holdings, Shiba Capital, Animoca Ventures, Morningstar Ventures, Woodstock Fund, DWF, and others.

RWA

Homium is a platform that offers homeowners a new way to access the equity in their homes without taking on extra debt. It partners with investors who help homeowners unlock the value of their homes in exchange for a share in the future appreciation of the property. Homium raised on April 16th a $10 million Series A round led by Sorenson Impact Group and Blizzard Group.